When it comes to investments, T. Rowe Price Group (Nasdaq: TROW) is thought of as a model of stability.

The 80-year-old company has $861.6 billion under management.

It manages dozens of stock and bond funds for individual and institutional investors.

T. Rowe Price currently pays a $0.57 per share quarterly dividend, or $2.28 on an annual basis.

It has an excellent track record of raising dividends. Not including a special $2 per share dividend in 2015, the company has raised its annual dividend every year since 1987. That includes the years during the financial crisis – impressive for a financial institution.

But T. Rowe Price hit a major snag last year.

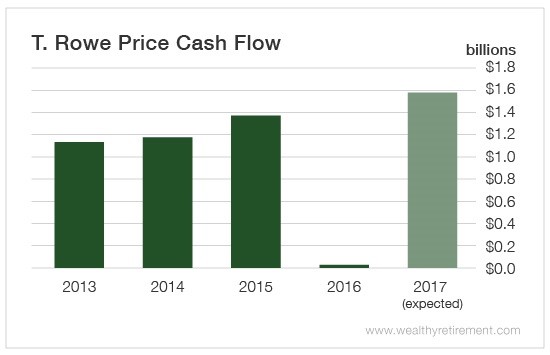

Its cash flow plummeted from $1.38 billion in 2015 to just $22.2 million in 2016.

A confluence of factors led to the 98% decline in free cash flow.

Investors pulled their money out of actively managed funds – like the ones managed by T. Rowe Price – and put it into passive funds, such as index funds and ETFs. More than $6 billion was withdrawn from T. Rowe Price’s funds in 2016.

The company also invested $1 billion more into its business than it did in prior years, as it is expanding distribution and technology platforms.

Both of those pressures on cash flow are expected to be gone in 2017.

In fact, in the first quarter of the year, T. Rowe Price generated $142 million in free cash flow, far eclipsing the total for the entirety of 2016.

In 2016, T. Rowe Price paid out $541 million in dividends. The company’s $22.2 million in free cash flow wasn’t close to being enough to fund the dividend.

This year, free cash flow is forecast to be more than $1.5 billion, which would more than cover the expected $588 million in dividend payouts.

Once the calendar turns over and last year’s horrible cash flow numbers are in the rearview mirror, T. Rowe Price will likely get an upgrade.

But for now, it has to prove it can return to previous levels of cash flow. Until then, we have to use the numbers that the company delivered. And on that basis, it deserves a low rating for dividend safety.

Leave A Comment