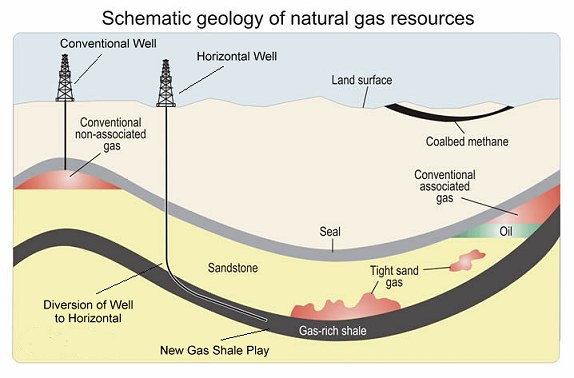

Technology continues to change our lives – mostly for the better. Whether it is advances in medical care like less invasive surgery, cheaper and better energy production via hydraulic fracturing, on-shoring more manufacturing via robotics, or improving the safety of our automobiles, aircraft and other modes of transportation, technology is everywhere around us and everywhere having an impact.

Many of the companies investing the most in technology are not considered “tech companies” because they are on the leading edge of technology uses well beyond Silicon Valley.

Innovation is where you find it. For me, limiting my interest to “Internet-based” tech like browsers and big data domination, or “social media” leadership, or “e-retailing” hegemony misses the whole point of how technology can be a force for powering the economy and energizing industry.

If you disagree and want only those companies in quotation marks above, almost any passive cap-weighted ETF will do. QQQ and ONEQ, while not really “tech” funds (but because they are cap-weighted,) has portfolios dominated by tech companies. For purer-play ETFs like IXN, XLK, VGT, FTEC, IYW, and IGM the percentage of portfolio in techs is even higher.

From a purely investment standpoint, the most successful way to have profited from tech stocks in the past couple years has been to buy the FAANGs. (Facebook, Apple, Amazon, Netflix and the different iterations of Google.) The next best was to buy ETFs like those above since the FAANGs are typically 20-40% or more of their portfolios. It is a given in many quarters that the question isn’t if, it’s when, everything we do will be either controlled by or of direct and immediate benefit and massive profit to these companies, so there was no concern for what price one paid.

The big discussion on tech message boards was more about whether Google would conquer all — or would it be Amazon? Such narratives are dangerous. Thinking in a linear fashion – that what is will continue to be and can be meaningfully extrapolated into the distant future – or in a binary way – that if Outcome A doesn’t happen that means that Outcome B must – are sure paths to a pauper’s grave. Right now, critical thinking and a little review of history are of far greater value.

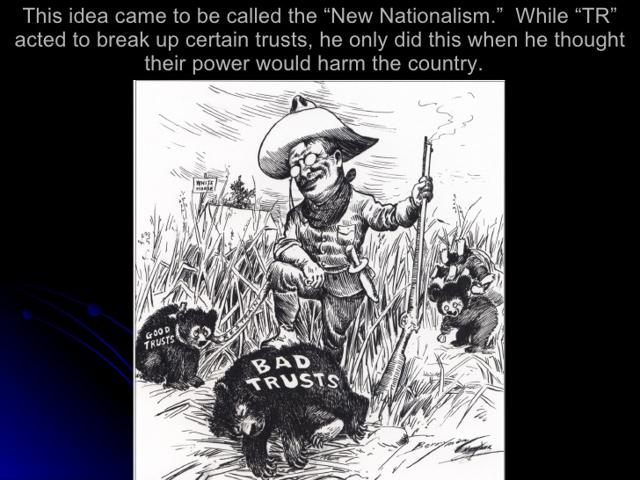

John D Rockefeller’s Standard Oil empire was to the industrial age and automobile transportation infancy what today’s FAANGs are for many: an unstoppable force. Until the politicians stepped in. As they did with DuPont, the New Haven Railroad and 40 others, A politician can destroy a hegemon in the blink of a regulation or the hint of a busted trust.

More recently, when Apple looked to be down for the count, Microsoft was the company in every institutional portfolio. The future was computing and Microsoft controlled the operating system that allowed us to compute. hen Microsoft took a hard fall. It took a complete reassessment and a lot of innovation for Microsoft to regain some of its former glory. (But FAMNAGs just doesn’t roll off the tongue as trippingly so MSFT is unlikely to bump through into the higher acronymic atmosphere.)

Even if no rabble-rousing politician or politicians change the course of these companies’ success, some of us are reluctant to buy something so highly-valued in what may prove to be so late in the cycle. I just can’t bring myself to pay close to 200 times earnings and receive not a penny in dividends from the likes of Amazon or Netflix, brilliant companies with first-mover advantage and moats they are reinforcing and expanding daily.

However, I try never to let my respect for a company or its management or its service cloud my judgment as to the value of its shares at a given price. I can love Amazon (and do) without thinking their stock “has to” continue on its current linear route with nary a bump in the road.

That brings us to equal-weighted tech ETFs. They make more sense, at least on paper, and in a “normal” market – whatever that is – they will provide better diversification and might also provide better total returns. But not lately. The momentum has clearly been with the mega-giants that comprise the FAANGs and a few of their closest friends (Nvidia, Microsoft, etc.) To buy into the equal-weighted philosophy is easy but the reality has been that you have been left well behind the major tech moves if you did so – up until now anyway. RYT is the best known of these, but QQQE and QQEW are also reasonably-sized players in this space.

Leave A Comment