Despite Facebook’s blockbuster $3 billion Oculus acquisition in 2014, VR/AR has been too early stage for large scale mergers and acquisitions (M&A) so far. But that’s set to change in the next 12 to 18 months, so let’s look at what could drive M&A deals going forward.

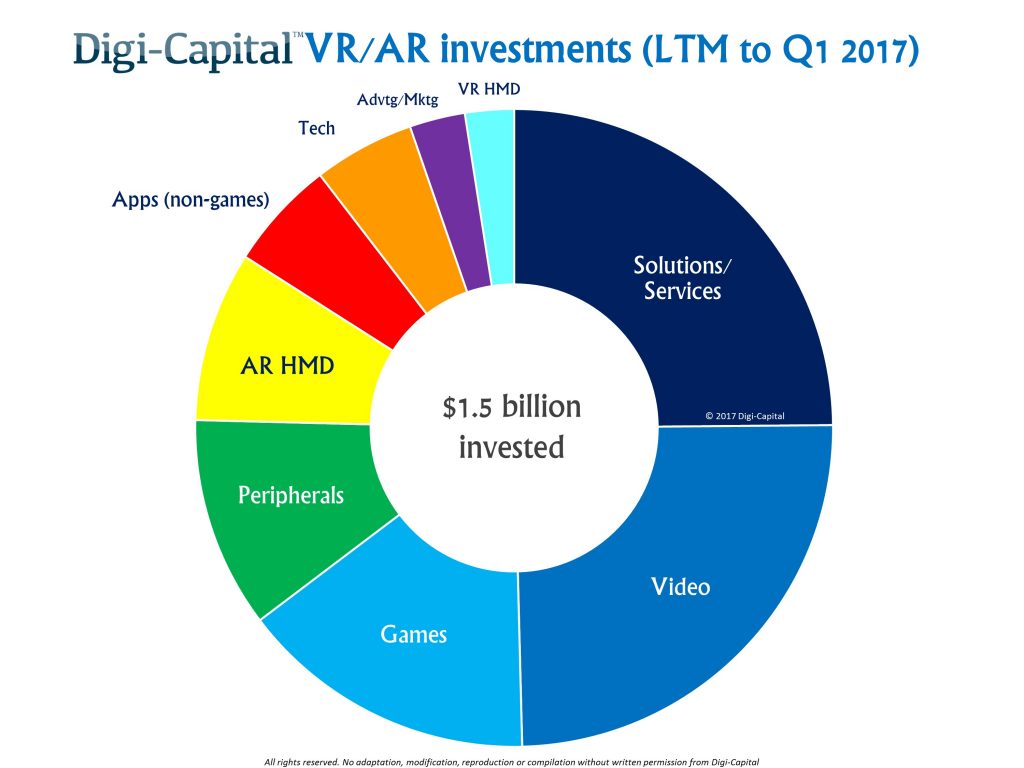

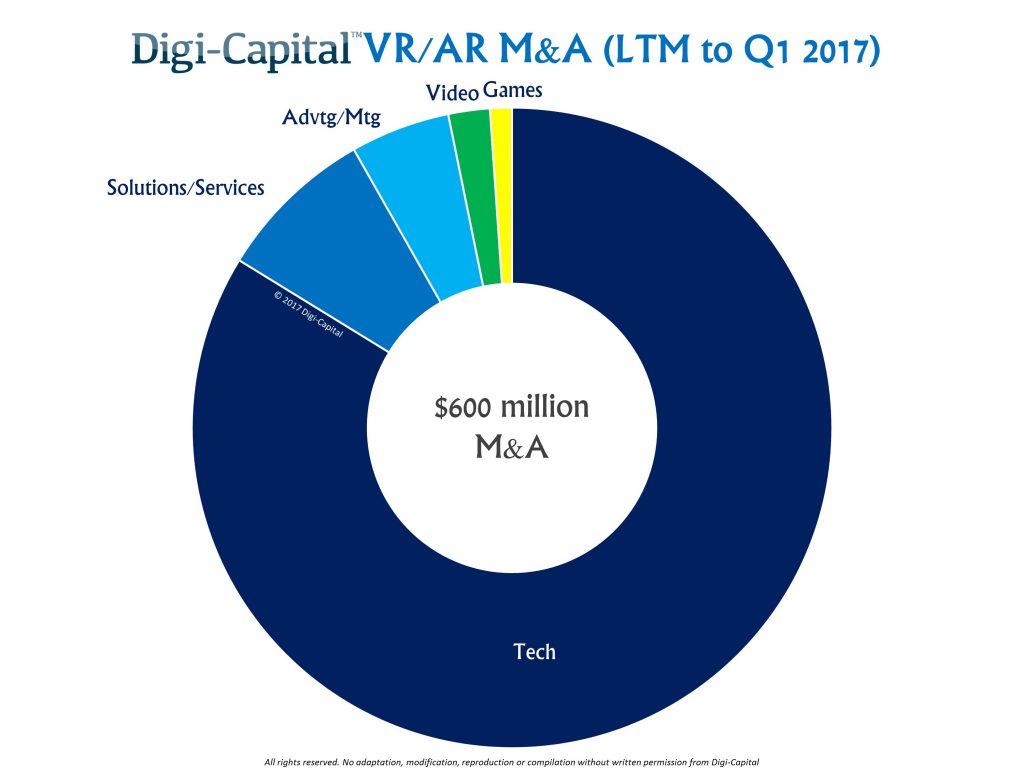

Where Digi-Capital’s Augmented/Virtual Reality Report Q1 2017 and deals database tracked $1.5 billion investments in the last 12 months to Q1 2017, there was only $600 million of M&As in the same period. That dynamic of investments outstripping M&As is typical of early stage tech markets, when deal making is all about investment for growth rather than consolidation for dominance or cost.

However as the VR/AR market continues to scale, M&A deal flow is on the rise. Major corporates are actively honing their strategies on where and who to buy. Startups are also considering larger corporate parents to provide safe harbor, until the market is big enough for their business models to sing. And as often happens, early stage companies which can’t raise the next round are looking for mergers with better funded startups to leverage their tech and talent.

It’s good to be the king

VR’s apex predators are Facebook’s Oculus Rift and HTC’s Vive. But apex predators are giant, toothsome beasts that need to eat. A lot.

High-end PC VR is compelling. However buying the headset, controllers, PC, graphics card, and premium software to make it fun put it beyond the reach of mass market consumers. So while there are hundreds of thousands of Oculus and Vive users today, Digi-Capital’s forecasts see console/PC VR’s combined installed base only topping 20 million units by the end of the decade (Note: this is installed base, not annual unit sales, and excludes higher volume mobile VR). And this is for companies used to operating in markets with users counted in the billions.

Facebook’s enterprise value is close to $400 billion, it paid $3 billion for Oculus, and Mark Zuckerberg might invest $3 billion more on top of that. Facebook could fund Oculus’ PC division indefinitely, and HTC also has a large cash stockpile (although perhaps not quite such a big one) to fund the Vive division. With two T-Rex’s and not enough food, something’s got to give at the high end. It’s not clear what deal (if any) might result, but watch this space.

Leave A Comment