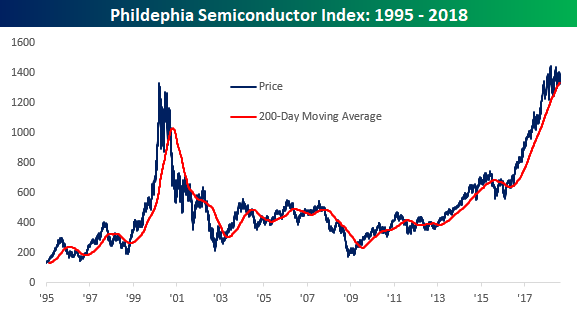

For much of the two-plus years since the Brexit vote in June 2016, semiconductors were one of, if not, the market’s biggest leaders. From the time it broke out in mid-2016 through its highs earlier this year, the Philadelphia Semiconductor Index (SOX) more than doubled, taking out its dot-com highs in the process.

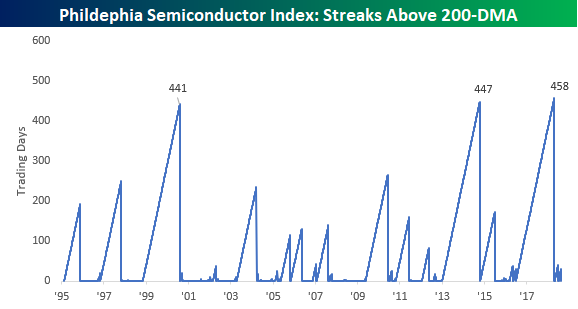

Another notable aspect of the rally in semis during that span is that the group saw a record run of 458 consecutive daily closes above its 200-day moving average. Going back to 1995, this was just the third such streak of more than 400 consecutive closes above the 200-DMA, only eking out the two other streaks from 1999/2000 and 2013/2014 by a number of days.

For much of the last 20+ years, semiconductors have been considered a leading indicator for the Technology sector, if not the market as a whole. While trends tend to change over time as certain sectors of the economy lose their relevance and are overtaken by others, recent price action in the semis has been a bit concerning. When the SOX first broke its streak of consecutive closes above the 200-DMA back in April, it quickly bounced back more than 15%. While the snapback was impressive, the rally stalled out short of a new high and pulled back down to its 200-DMA. On the second test of its 200-DMA in early July, the SOX bounced again, but that rally not only failed short of a new high, it also came up short of the prior lower high.

Since that most recent lower high, the SOX has once again broken below its 200-DMA and still has yet to bounce. Not only that, but if it doesn’t find its footing soon, it will become increasingly likely that the SOX will fall below levels seen in early July, resulting in a lower low. Two lower highs followed by a lower low? From a technical perspective, that wouldn’t be an especially promising pattern.

Leave A Comment