One important dynamic of portfolio construction and risk management is understanding how your stocks fluctuate in relation to the broader market. This factor is often referred to as “beta,” which is essentially the historical volatility of a stock or fund in relation to a benchmark such as the S&P 500 Index.

The higher the measured beta of your holdings, the greater price fluctuations they will have in comparison to the benchmark. A high beta score doesn’t necessarily mean that your investments will outperform on the upside or underperform on the downside. It simply means they have exhibited characteristics of outsized moves or over-reactions in the past.

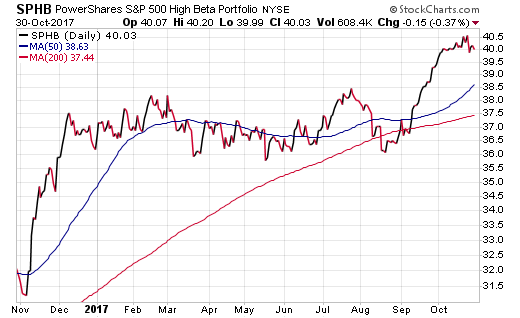

An exchange-traded fund that tries to capture this phenomenon is the PowerShares S&P 500 High Beta Portfolio (SPHB). This ETF identifies 100 stocks from within the broader S&P 500 Index with the highest historical sensitivity to price moves over the preceding twelve months. To achieve that goal, it continually reconstitutes and rebalances the basket of holdings on a quarterly basis to ensure the underlying portfolio is meeting its expected factor dynamics.

Each holding within SPHB is given an equal weighted portion of the portfolio at the rebalancing marker. This allows every company to provide a relatively similar contribution to the overall performance of the fund.

One of the more common attributes shared among stocks in the high beta index is their smaller size. SPHB is filled with companies from the bottom quartile of the market-cap weighted S&P 500 Index. This includes stocks such as Under Armour Inc (UAA), Chesapeake Energy (CHK), and Navient Corp (NAVI). Furthermore, there isn’t a single stock from the top 10 largest holdings in the SPDR S&P 500 ETF (SPY) represented in the high beta portfolio.

To underscore this point, the weighted average market cap of SPHB is $27.5 billion compared to the mean market cap of SPY at $47.38 billion. It’s well understood that smaller stocks tend to be more volatile overall and the portfolio construction data backs up that thesis.

Leave A Comment