Globally synchronized growth has taken a beating so far in 2018. As a narrative, one factor after another has turned against it. Europe was booming and was even going to be in a leadership position in the global economy. Now? Not so much. The dollar would continue to fall just as it did in the years before Bear Stearns, a return to something like normalcy. Again, that’s been rudely interrupted.

More than those was China. The Chinese economy after suffering the “unexpected” setback of 2014-16 was roaring back to life. It would deliver marginal growth the rest of the worldwide system needed to get back on track finally. Last year, many people were so convinced of it they even saw the PBOC pursuing a “tightening” interest rate policy. China’s economy was in danger of being too good.

What, then, might they say about Chinese money rates today?

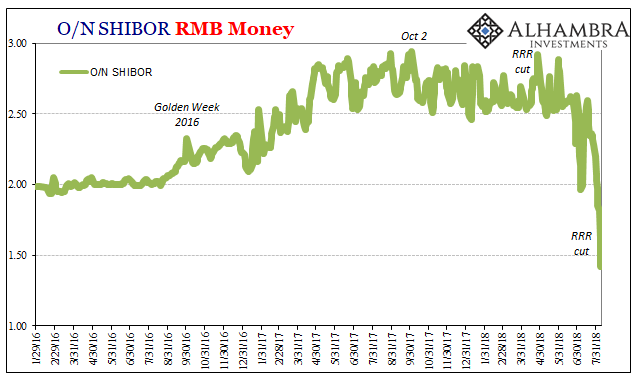

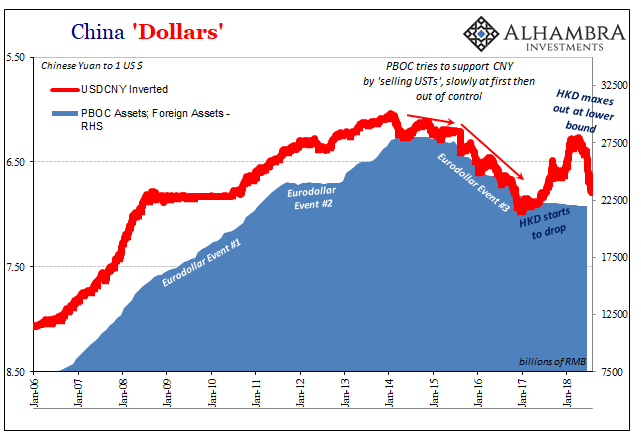

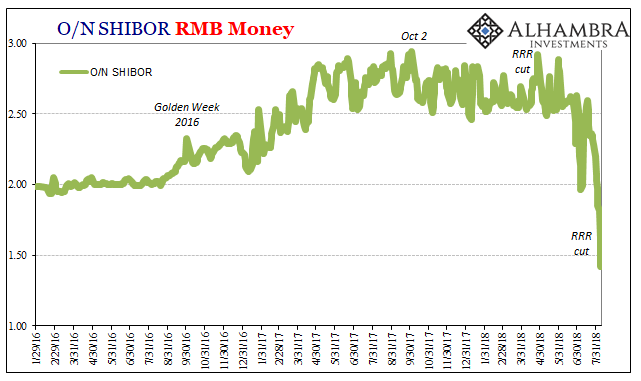

Rates in China have collapsed over the past few days. There can be no doubt as to a shift in perception if not policy. Rather than higher rates, the Chinese central bank has been fighting against them for a long time (“dollars” on the asset side of the central bank balance sheet). Going back to October, they’ve become only more aggressive over time.

With CNY falling hard anyway, why hold back any longer?

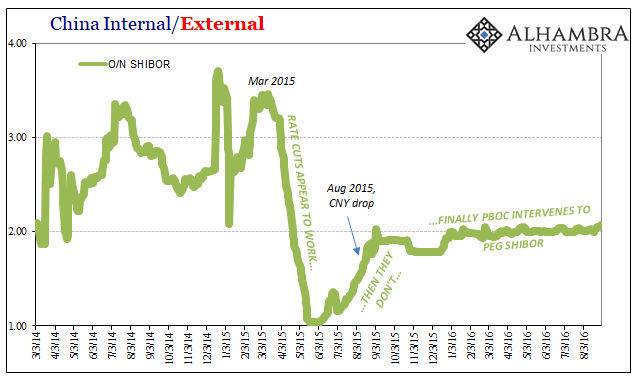

The Chinese economy is in trouble and officials know it. How do we know they know? We’ve seen this thing before. More than that, it’s when it last occurred that we should take note. The similarities are beyond remarkable.

The history and pattern are practically identical. In narrative form, it is a carbon copy. In 2014, global growth was supposedly picking up just as it was presumed last year. The PBOC was also in 2014 thought to be biased by higher interest rates in anticipation of economic acceleration.

Leave A Comment