VF Corporation (VFC – Free Report) reported lower-than-expected fourth-quarter 2017 results, wherein both earnings and revenues lagged estimates. However, both top and bottom lines improved year over year. This marked the company’s top and bottom line miss after two consecutive quarter beats. Further, the company provided guidance for the transitional quarter ending March 31, 2018.

Following the dismal results, shares of this branded apparel retailer declined nearly 5.4% in the pre-market trading session. However, this Zacks Rank #3 (Hold) stock has jumped 33% in the last six months, outperforming the industry’s rise of 21.5%.

Q4 Numbers

The company’s quarterly adjusted earnings from continuing operations came in at $1.01 a share, which jumped 13% year over year but missed the Zacks Consensus Estimate of $1.02. Earnings per share for the quarter included a 4 cents contribution from the Williamson-Dickie acquisition.

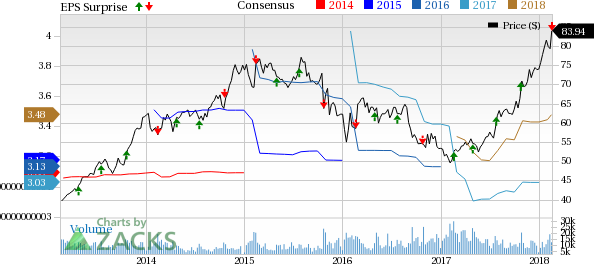

VF Corporation Price, Consensus and EPS Surprise

VF Corporation Price, Consensus and EPS Surprise | VF Corporation Quote

VF Corp. generated total revenues, including royalty income, of $3,649.3 million, that increased about 20% year over year but lagged the Zacks Consensus Estimate of $3,662 million. Net sales of $3,624.8 million also advanced 20% from the prior-year quarter, including contributions from the Williamson-Dickie acquisition. On a currency-neutral basis, revenues jumped 18%.

Excluding the Williamson-Dickie acquisition, revenues were up 12%, while currency-neutral revenue grew 10%, driven by continued strength in the company’s international and direct-to-customer platforms, Outdoor & Action Sports coalition and workwear businesses.

Adjusted gross margin increased 60 basis points (bps) to 51.6%, thanks to better pricing, lower restructuring expenses and a favorable mix-shift toward high margin businesses, which was partly negated by Williamson-Dickie acquisition and foreign currency headwinds. Excluding the aforementioned acquisition, adjusted gross margin expanded 140 bps to 52.4%. Notably, foreign currency hurt gross margin by 10 bps.

Leave A Comment