(Photo Credit: Mike Mozart)

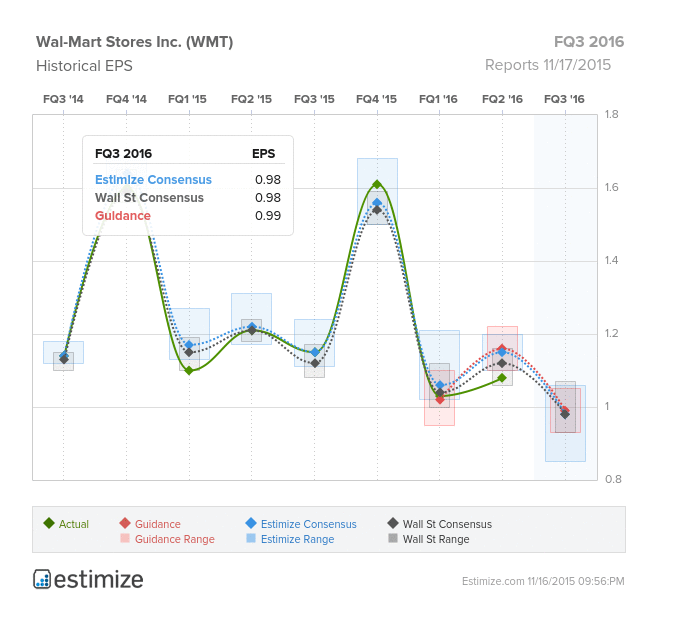

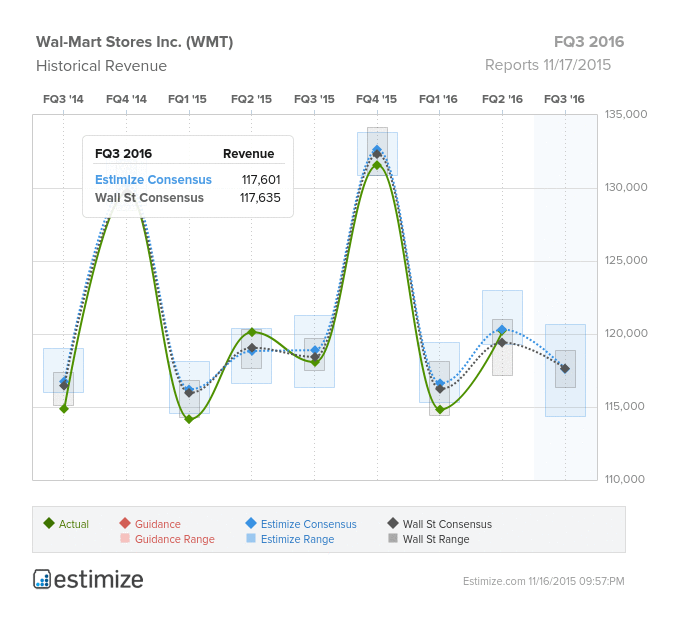

Since Wal-Mart (WMT) announced on October 14th that fiscal year 2017 EPS results could be down as much as 12% due to increased costs, the Estimize EPS consensus for FQ3 2016 has fallen 3 cents to $0.98, and revenues have declined $553M to $117.613B. While the Estimize EPS consensus is in-line with Wall Street, revenues are slightly below the sell-sides expectation for $117.635B. The world’s largest retailer warned that heightened spending on employee wages and e-commerce investments were to blame for the cut in guidance, as well as the continued negative impact of the strong U.S. dollar. The announcement lead to a 10% drop in the stock which fell to a three year low.

Back in February, Wal-Mart announced that they were raising their entry wages to $9 an hour, and that by February 2016 all employees would earn at least $10/hour. Manager roles were raised to $13, and will increase to at least $15 an hour early next year. While the move was great for the company’s smeared public image, it’s one that will cost $2.7B through the next fiscal year.

The main concern for Wal-Mart is competition from Amazon, leading to the heavy spending to develop their website. The company will funnel close to $2B into e-commerce and digital platforms next year in order to combat sluggish sales and slowing traffic. Wal-Mart began offering an unlimited shipping membership for $50 annually, but does not offer the other perks of Amazon Prime.

As with all retailers, same store sales and traffic are two of the most important metrics to watch. Last quarter Wal-Mart put up SSS of 1.5% driven by 1.3% traffic. Even more impressive were the comps on the company’s Neighborhood Market stores, with SSS increasing 7.3%. The Neighborhood Markets concept introduces smaller stores, about ? the size of Wal-Mart Supercenters, to town plazas and areas that can’t accommodate a Supercenter. The goal is to compete with traditional supermarkets like Whole Foods and Kroger.

Leave A Comment