Photo Credit: Mike Mozart

Party City Holdco Inc. (PRTY) Consumer Discretionary – Specialty Retail| Reports March 10, Before Market Opens

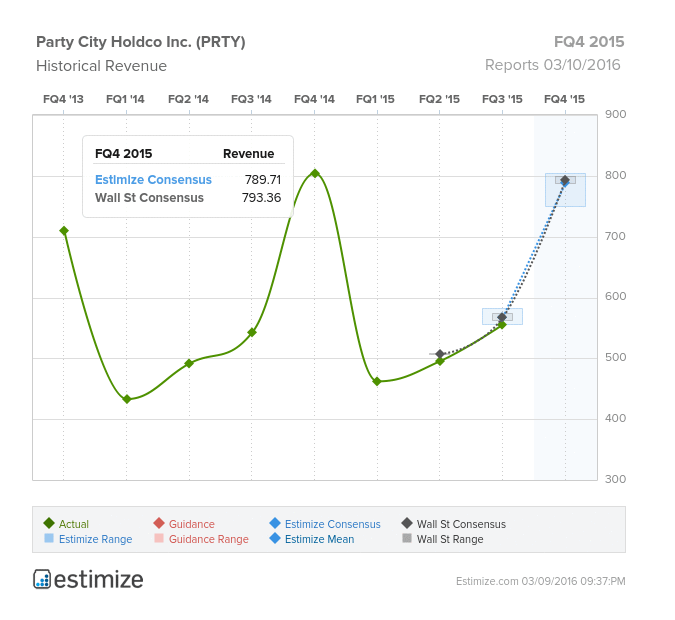

Amongst the batch of recently public companies reporting this week, party store supplier, Party City (PRTY) is scheduled to report fourth quarter earnings tomorrow, before the opening bell. After selling for $21 in its April 2015 IPO, shares have dropped 47.8% to $10.81 where they are today. The party supply retailer has managed to miss on both the top and bottom line in each of its first two reported quarters. This quarter, the Estimize consensus is calling for EPS of $0.75 and revenue expectations of $789.71 million, right in line with Wall Street on the bottom line but $2 million less in sales. Compared to the year prior, earnings and sales are projected to decline 15% and 2%, respectively.

Unfortunately, Party City’s first year as a public company has followed a similar downward trend of many recent IPO companies. Last quarter the company reported unfavorable YoY growth as competitive pressures eroded its market position. For the entire Halloween season and first month of the fourth quarter, Party City announced 3.3% gains in comp sales and an average sales increase per Halloween City store of 1.9%. However, compared to ecommerce giants like Amazon, Party City offers no real competitive advantage besides brand recognition. If the company can rebound this quarter it will happen on the back of movie themed merchandise, particularly Star Wars. Party City is hoping the massive gains Disney saw from the blockbuster hit carries over to it’s own bottom-line. Star Wars, unlike Frozen, is a costume business for Party City, so any gains the party supplier sees from the movie will be in the months leading up to Halloween.

In the past few months Party CIty has ramped up its branding and marketing efforts including a partnership with Staples and a variety of targeted campaigns. So far, the company has doubled the number of free shipping days in 2016 than it offered in the final 6 months of 2015. Promotional offers on top of ecommerce growth is expected to carry growth into fiscal 2016. Moreover, with the Frozen sequel looming, Party City can expect to see robust sales growth as new merchandise will likely be very popular. In the near term, Party City investors appear as if they will suffer a similar fate as shareholders of other newly public companies.

Leave A Comment