<< Read More: The Perils Of Citi: The Last Of The Eurodollars Part 1

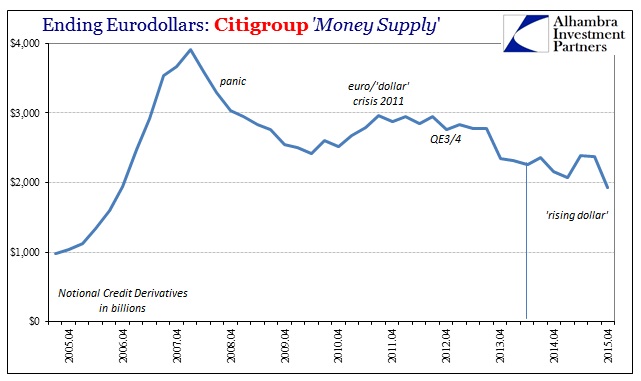

Even if the eurodollar paradigm had started shifting long before the full panic, this is not to say that various individual firms have not tried to rekindle the former construction; in fact, I have paid particular attention to those who at various points attempted the recreation. Citigroup is one of those though it isn’t clear what the overriding strategy really is. In terms of the bank’s derivative book, Citi had been expanding even in CDS on a limited basis in what was obviously a trial related to the perceived cover of QE1 and QE2.

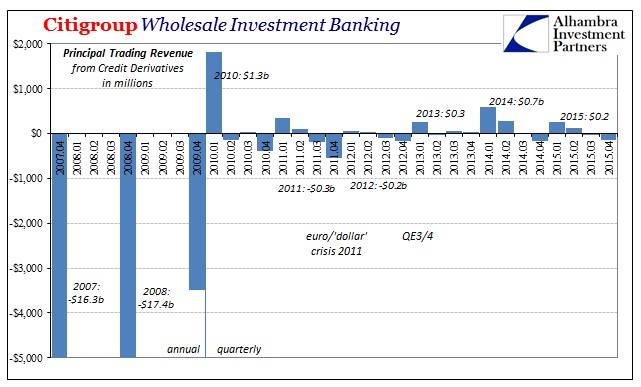

You can see the contradictions in this dark leverage space in sharp contrast to what we supposedly know of banking and even asset markets – though Citi’s ICG unit was losing about $22 billion in negative revenue in 2007, total notional exposure kept rising until March 2008. From the end of Q2 2007 (starting with Q3 and the events of August 2007) until the end of Q1 2008, Citi’s “credit products” notionals jumped by $1 trillion, or 24%. Was that the human instinct to chase bad trades to “make it all back”? Or was it being locked into arrangements (even systemically) that were far more difficult from which to extract positions once it all started moving against? The twin $20+ billion losses for 2007 and 2008 suggest the latter.

The revenue reports presented immediately above are yet another reorganized format for principal transactions, meaning that losses and revenue totals are not directly comparable with prior totals. Citi reported positive revenue of $1.3 billion for “credit derivatives” in Q1 2010 but not much else since then. In fact, the revenue has been slightly higher as the CDS notionals have rolled off since QE3 and the middle of 2012.

Like the pre-crisis era, if direct principal transactions revenue isn’t the point, and it clearly wasn’t/isn’t, then what is the bank doing? Is it a market share push, sort of a “loss leader” strategy to provide a money dealing service in hopes of capturing other business from clients? Or is/was the bank using its CDS book in combination with other internal activities, warehousing, market making and all that, leaving the exact structure to imagination again?

In terms of interest rate swaps, Citi again bucked the tide and had been expanding its notional offerings (regulations not playing a role?) despite $9 billion in losses in 2008 (again, that revenue total is different under the current format, likely including some of what used to be ICG’s credit losses as well as most if not all of what the bank formerly categorized as “fixed income” principle transactions). In 2009, under QE1 and all the other “stimulus support”, principal transactions revenue now attributable to interest rate swaps jumped to +$6.2 billion.

Leave A Comment