Big-tech behemoth Microsoft Corporation (MSFT) leapfrogged ExxonMobil Corporation (XOM) last week to become the second-largest company in the world by market cap. MSFT stock weighs in at a valuation of $405 billion compared to $402 billion for XOM stock. Both

November 21, 2014

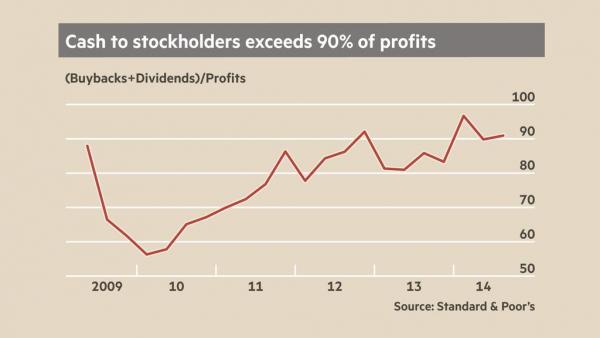

The global financial system has come unglued. Everywhere the real world evidence points to cooling growth, faltering investment, slowing trade, vast excess industrial capacity, peak private debt, public fiscal exhaustion, currency wars, intensified politico-military conflict and an unprecedented disconnect between debt-saturated real economies and irrationally