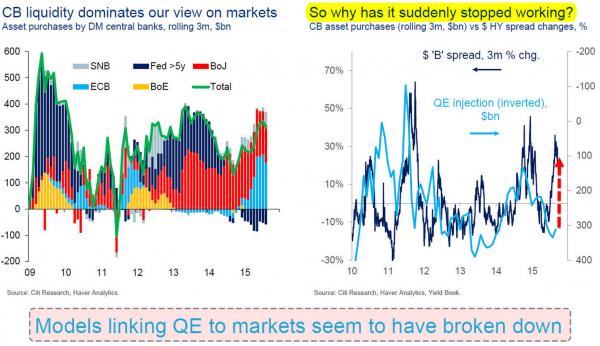

It is more evident than ever that the world economy is heading into a deflationary conflagration, but today’s generation of house trained bulls wouldn’t recognize a warning if it slapped them upside their horns. They refused once again last week to exit the casino because they got

October 18, 2015

This past week I added National Beverage (NASDAQ:FIZZ), Global Brass and Copper (NYSE:BRSS) and Crown Media (NASDAQ:CRWN) to the Barchart Van Meerten New High portfolio for superior price momentum. National Beverage Barchart technical indicators: 96% Barchart technical buy signals 57.90+ Weighted Alpha Trend Spotter buy signal