One month ago, when looking at the dramatic change in the market landscape when the first cracks in the central planning facade became evident and it appeared that central banks are in the process of rapidly losing credibility, and the faith of an entire generation of traders whose only trading strategy is to “BTFD”, we presented a critical report by Citigroup’s Matt King, who asked “has the world reached its credit limit” and summarized the two biggest financial issues facing the world at this stage.

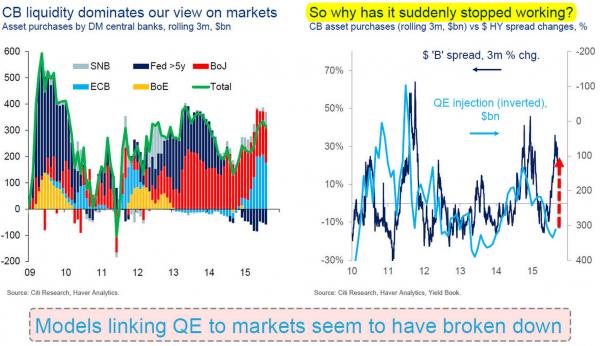

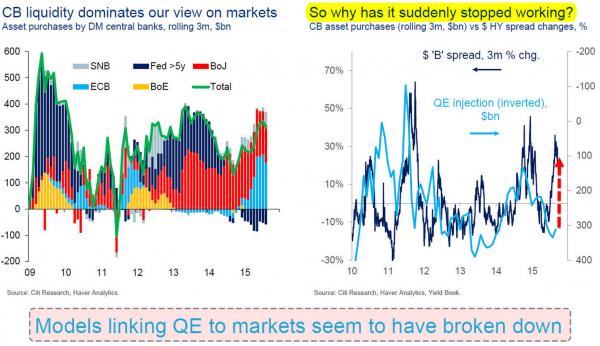

The first is that even as central banks have continued pumping record amounts of liquidity in the market, the market’s response has been increasingly shaky (in no small part due to the surge in the dollar and the resulting Emerging Market debt crisis), and in the case of junk bonds, a downright disaster. As King summarized it “models linking QE to markets seem to have broken down.“

Needless to say this was bad news for everyone hoping that just a little more QE is all that is needed to return to all time S&P500 highs. And while this concern has faded somewhat in the past few weeks as the most violent short squeeze in history has lifted the market almost back to record highs even as Q3 earnings season is turning out just as bad, if not worse, as most had predicted, nothing has fundamentally changed and the fears over EM reserve drawdown will shortly re-emerge, once the punditry reads between the latest Chinese money creation and capital outflow lines.

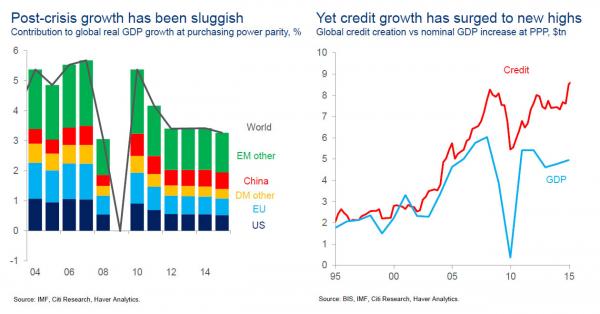

The second, and far greater problem, facing the world is precisely what the Fed and its central bank peers have been fighting all along: too much global debt accumulating an ever faster pace, while global growth is stagnant and in fact declining.

King’s take: “there has been plenty of credit, just not much growth.”

Our take: we have – long ago – crossed the Rubicon where incremental debt results in incremental growth, and are currently in an unprecedented place where economic textbooks no longer work, and where incremental debt leads to a drop in global growth. Much more than ZIRP, NIRP, QE, or Helicopter money, this is the true singularity, because absent wholesale debt destruction – either through default or hyperinflation – the world is doomed to, first, a recession and then a depression the likes of which have never been seen. By buying assets and by keeping the VIX suppressed (for a phenomenal read on this topic we recommend Artemis Capital’s “Volatility and the Allegory of the Prisoner’s Dilemma”), central banks are only delaying the inevitable.

Leave A Comment