It is more evident than ever that the world economy is heading into a deflationary conflagration, but today’s generation of house trained bulls wouldn’t recognize a warning if it slapped them upside their horns. They refused once again last week to exit the casino because they got another signal from Hilsenramp that the Fed is on “hold” until at least next March.

That means we are heading for 87 straight months of ZIRP. So you have to wonder if these fearless robo-machines and day-trading punters by now have come to believe that central banks have abolished time itself–to say nothing of the law of supply and demand.

As to the latter, any rational investor should have headed out of Dodge long ago in the face of the mother of all bond bubbles–a monumental worldwide distortion of debt pricing and “cap rates” which will bring down the entire financial system when it inexorably bursts.

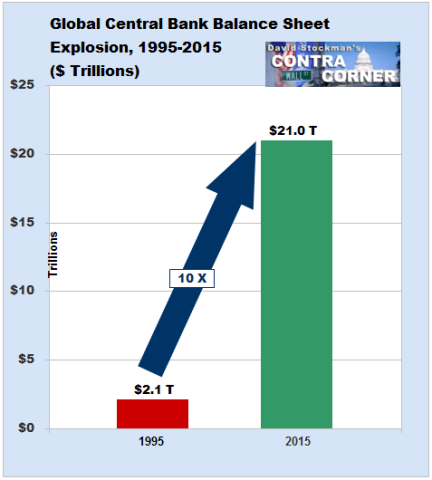

After all, how is it possible that sovereign debt prices and yields have not been drastically repressed by $19 trillion of central bank bond-buying during the last two decades?

The central banks have vast powers, of course, but repeal of the law of supply and demand is not among them. Their big fat bid, therefore, has dominated debt pricing on the margin for most of this century. Yet all that financial purchasing power was conjured from thin air by central banks.

Stated differently, these massive central bank debt purchases did not arise from society’s legitimate pool of savings set aside from current income. Instead, they amounted to a gargantuan fraud of the state, meaning that the financial system is infected with monetary rot to its very foundations.

Accordingly, the idea that historical (pre-1995) interest rate patterns over the course of the business cycle are relevant to today’s outlook is complete Wall Street flim-flam. Absurdly low interest rates, such as last week’s 60 basis points for two-year treasury notes or 210 bps for 10-year money, do not represent a surfeit of private savings; nor do they reflect business and household “hoarding” of cash in the face of a weak economy or near-term uncertainty, as the talking heads insist day after day.

No, they represent a giant surplus of finance—credit made from whole cloth by the central banks and collateral based Wall Street dealers and lenders. Unlike honest capitalist savings, these vast, meandering pools of liquidity slosh around in money markets, but never become permanently deployed in capital assets such as machinery or software.

Instead, they provide funding for financial market gamblers and carry traders. That is, these central bank generated finance pools provide the transient wherewithal of leveraged speculation; they are not permanent capital itself nor are they invested in long-term claims upon it. Accordingly, the price of financial assets is now artificial and wildly inaccurate–set by speculators front-running central banks, not price discovery among investors and savers.

Leave A Comment