1. The US-German 2-year interest rate differential (swap rate) is a useful directional guide to the euro-dollar exchange rate. At about 105 bp it is the highest since 2005. The US premium had peaked in late 2004 near 185 bp.

November 2, 2015

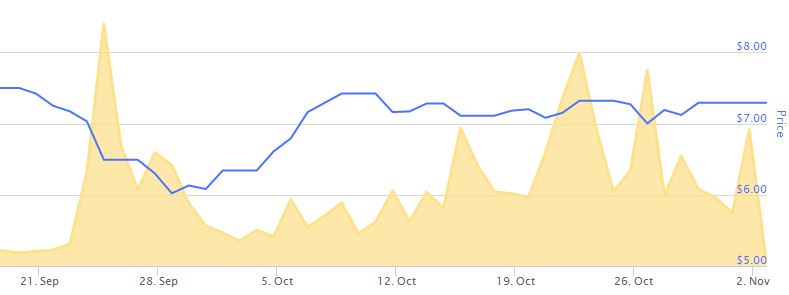

American International Group, Inc. (AIG – Analyst Report) is a world leader in insurance and financial services with operations in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional and individual customers through the most extensive worldwide property-casualty and life

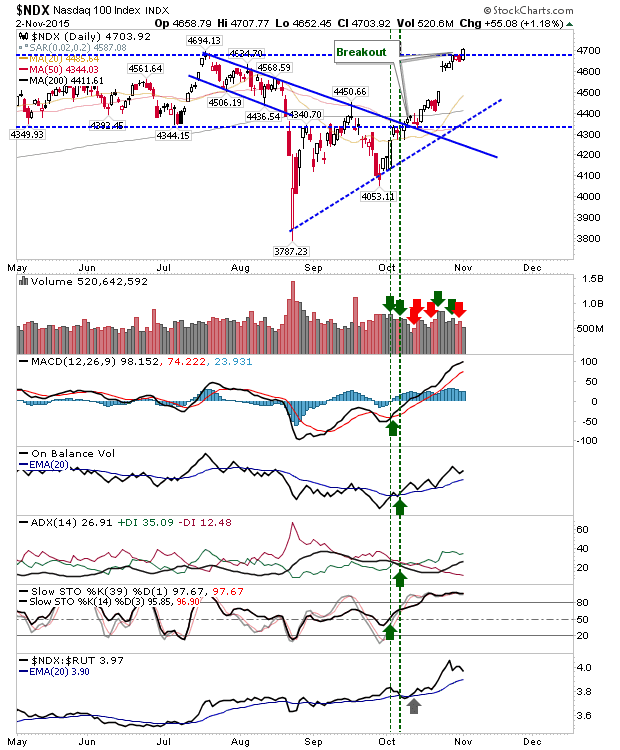

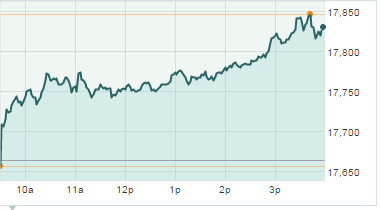

How Did the Stock Market Do Today? Dow Jones: 17,828.76; +165.22; +0.94% S&P 500: 2,104.05; +24.69;+1.19% Nasdaq: 5,127.15; +73.40;+1.45% The Dow Jones Industrial Average today (Monday) added 165 points to turn positive for 2015 after optimism increased due to positive manufacturing data from around the