I take a cyclical view on things. This means I can sometimes go years without making big changes in my views or portfolio. This is a very intentional construct and I think it’s one that most people should adhere to.

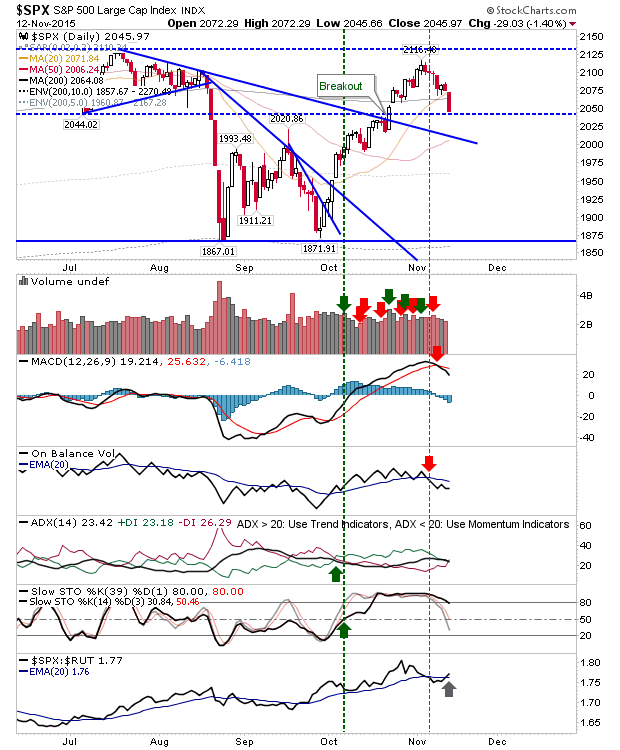

November 12, 2015

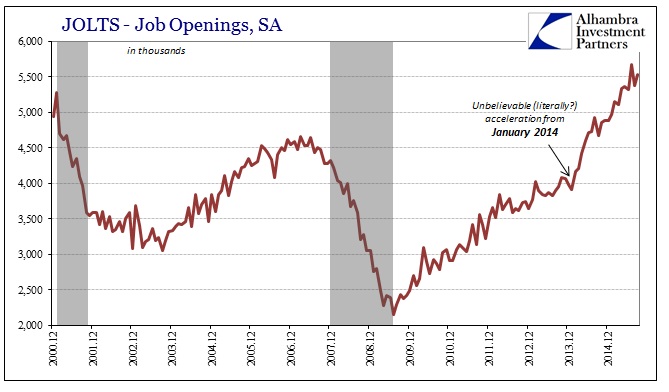

The ISM released their monthly manufacturing report earlier this week. Although the headline number was a barely positive 50.1, new orders increased 2.8 and production advanced 1.1 (both increased to 52.9).These increases will hopefully keep next month’s number positive.However, only 7/18 industries reported