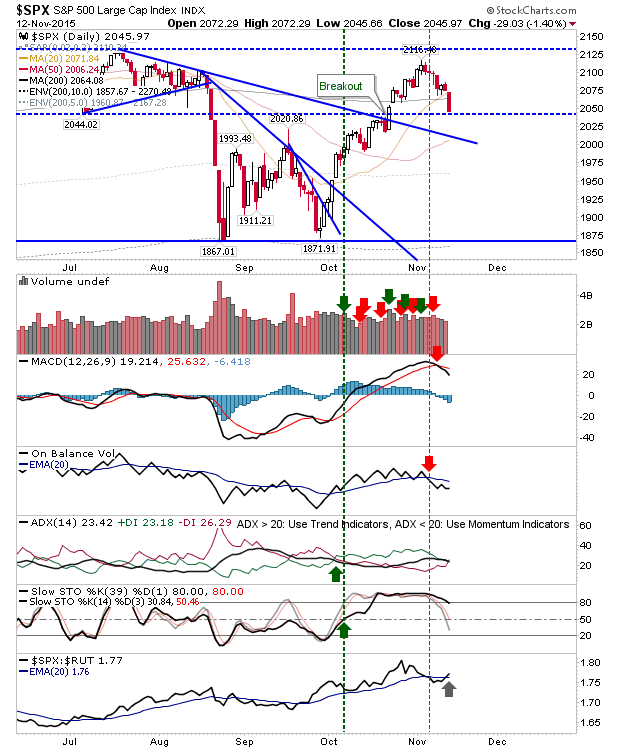

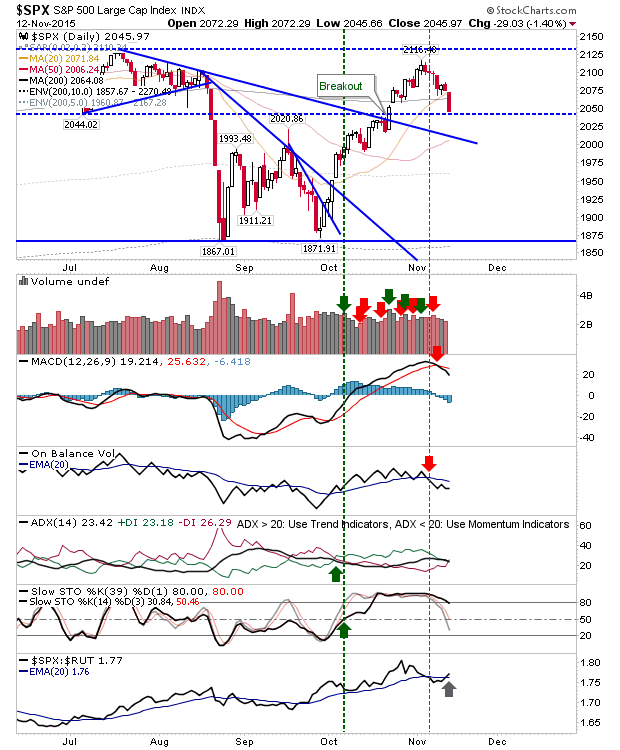

There was no doubt who gained control of markets today. The S&P cut clean through the 200-day MA and is on course to test former resistance turned support. This latter level will soon coincide with the 50-day MA. Relative performance has pushed ahead of the Russell 2000.

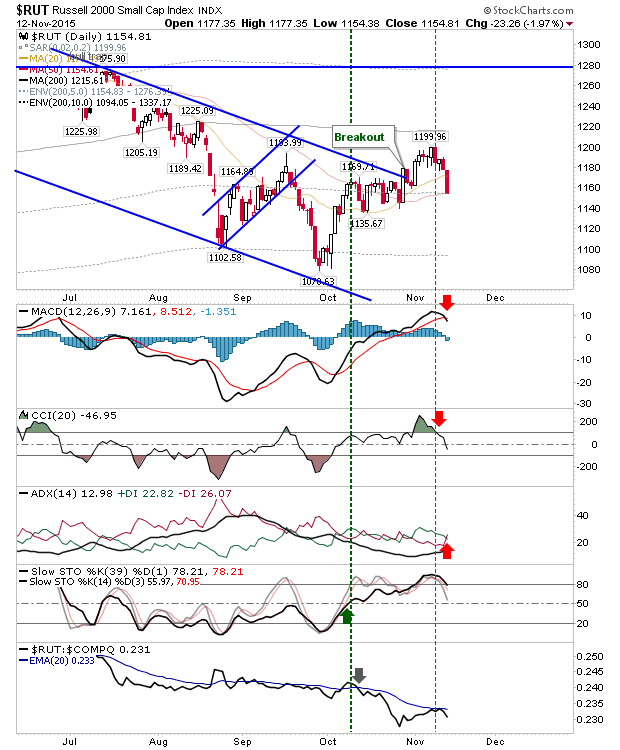

The Russell 2000 collapsed back to its 50-day MA in what was the biggest loss on the day. The next retest level is the October low. Today’s losses were accompanied by a ‘sell’ trigger in the MACD and a bearish cross between +DI/-DI. Today’s losses also saw a return to weakness in the relative performance of the index to the Nasdaq and S&P. This is an ugly picture for bulls and long term share holders.

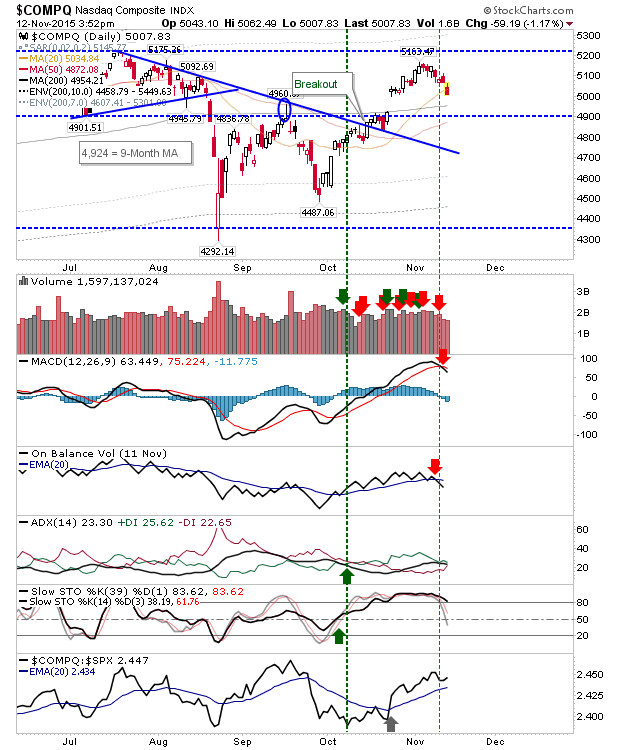

The Nasdaq took relatively mild losses and is above its 200-day MA. Selling volume was also light. The index holds on to ‘sell’ triggers in On-Balance-Volume and the MACD. The next few days are looking like they will be a battle between Small and Large Caps, with Tech indices flying below the radar.

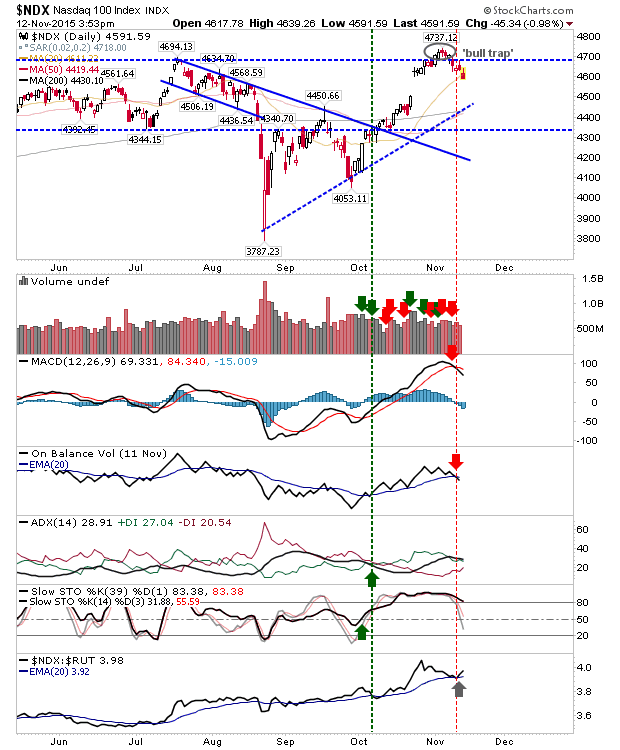

Shorts will be wanting weakness in Small and Large Caps to twist the knife for longs caught by the ‘bull trap’ in the Nasdaq 100.

Today was the first day to hurt bulls, or at least buyers who bought the September lows and looking for an opportunity to get out. Profit Taking is likely to continue.

Leave A Comment