Today’s the big day… Mario “whatever it takes” Draghi is expected to goose up stock markets with more stimulus measures. On the table is more QE… and further cuts to the key lending rate. The Chinese feds are also supposed

December 3, 2015

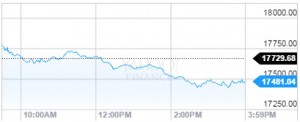

How Did the Stock Market Do Today? Dow Jones: 17,477.67; -252.01; -1.42% S&P 500: 2,049.62; -29.89; -1.44% Nasdaq: 5,037.53; -85.70; -1.67% The Dow Jones Industrial Average today (Thursday) plunged 252 points after European Central Bank President Mario Draghi surprised the markets by cutting interest rates and boosting