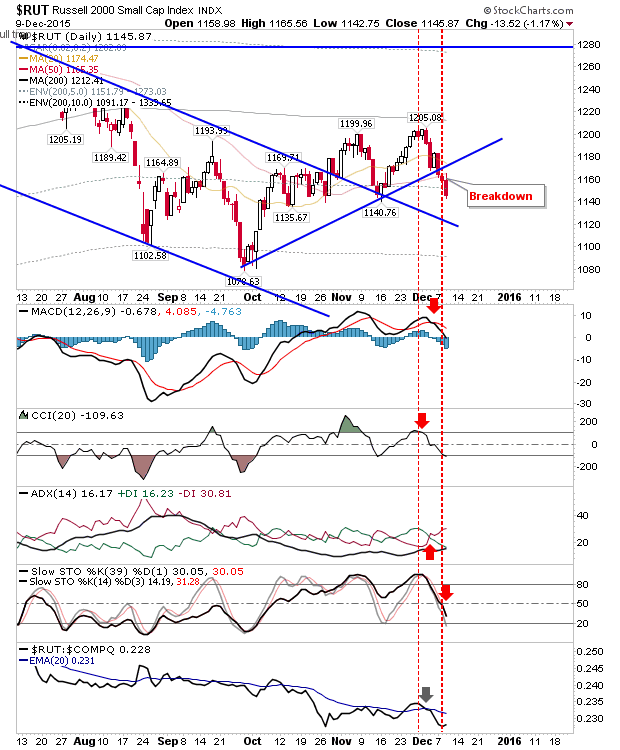

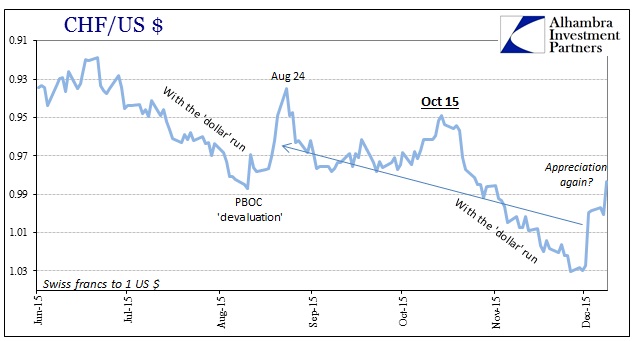

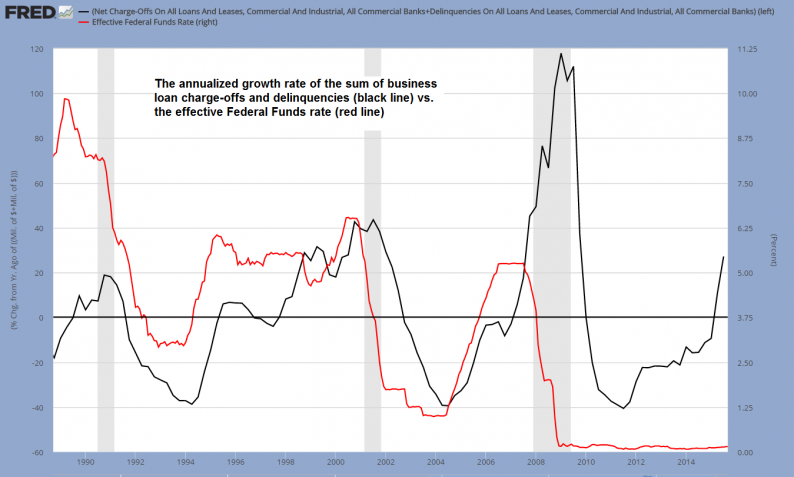

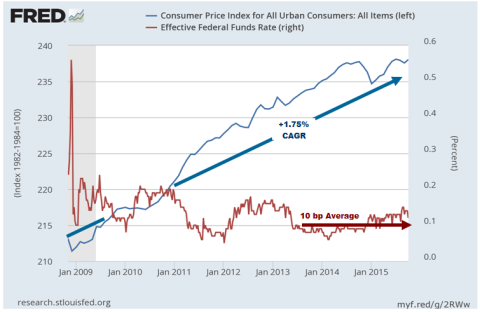

This belongs with the last post on the highly “disturbed dollar” but I felt it deserved its own separate piece to feature downstream of funding. Given the liquidity backdrop describing a broad range of extraordinarily disconcerting prices and liquidity rates, the selloff

December 9, 2015