It looks like 2016 will be the year that humanfolk learn that the stuff they value was not worth as much as they thought it was. It will be a harrowing process because a great many humans are abandoning ownership

January 12, 2016

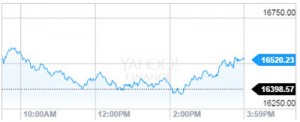

How Did the Stock Market Do Today? Dow Jones: 16,516.22; +117.65; +0.72% S&P 500: 1,938.68; +15.01; +0.78% Nasdaq: 4,685.92; +47.93; +1.03% The Dow Jones Industrial Average today (Tuesday) gained 117 points despite another sharp decline for crude oil prices. The markets earned a boost as technology and healthcare