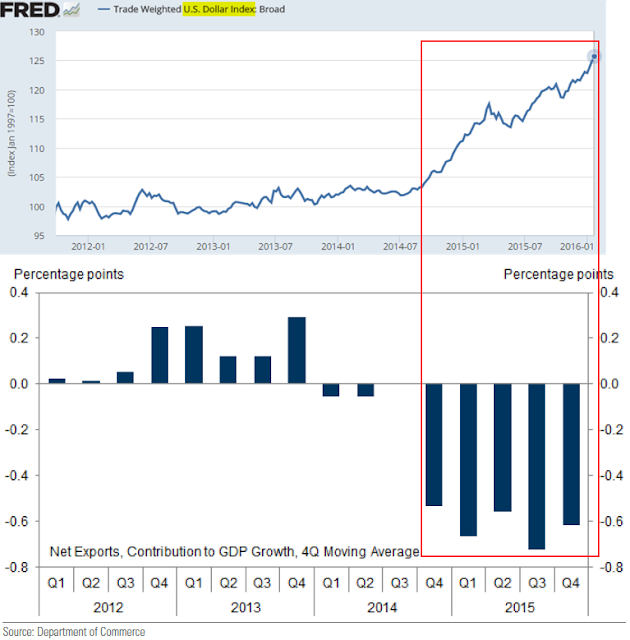

We continue to receive questions about the impact of the recent dollar strengthening on the US economy. The most immediate impact of course is on trade, which has created an immediate drag on the GDP growth. Source: St Louis

January 30, 2016

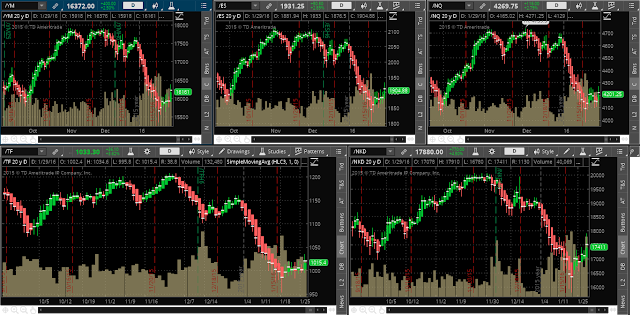

Was Friday’s world-market rally serious and sustainable, or simply a knee-jerk reaction to Japan’s surprise NIRP (negative interest rate policy) announcement (including some shorter-term short-covering action) and “end-of-month window dressing” by fund managers? Perhaps the following update to my last post will