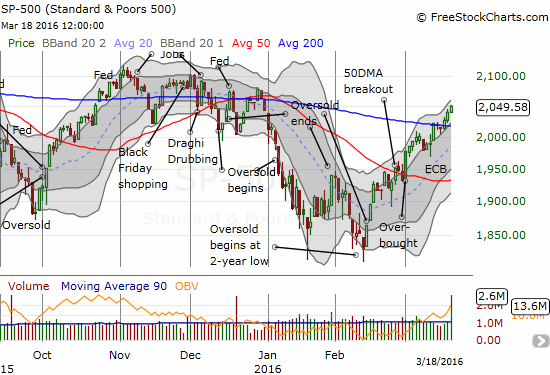

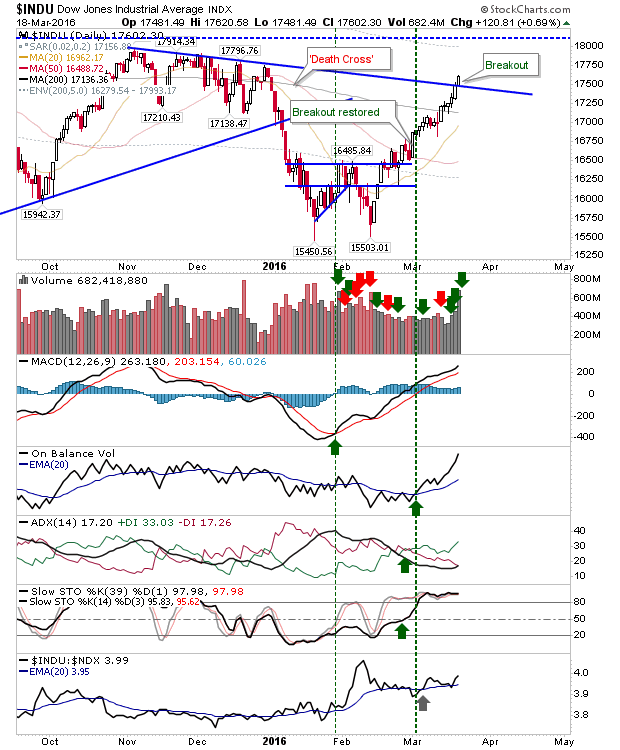

…We can’t rule out the possibility that, at some point in the next few years, our economy will slow, perhaps significantly. How would the Federal Reserve respond? What tools remain in the monetary toolbox? In this and a subsequent post,

March 19, 2016