General Electric Company (GE) is a diversified technology and financial services company and is listed on the New York Stock Exchange (NYSE) with a market capitalisation of around $290 billion. Price last traded at $30.92. Let’s begin the analysis by

March 20, 2016

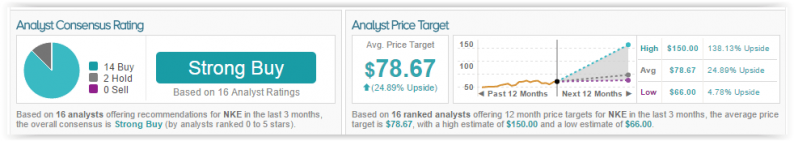

Product innovation, restructuring plans, falling oil prices, and debt levels color this week’s earnings reports from Nike Inc. (NYSE: NKE), StemCells Inc. (Nasdaq: STEM), Petroleo Brasileiro SA Petrobras (ADR) (NYSE: PBR). Let’s take a closer look at what analysts are looking for from these companies: Nike Inc Nike