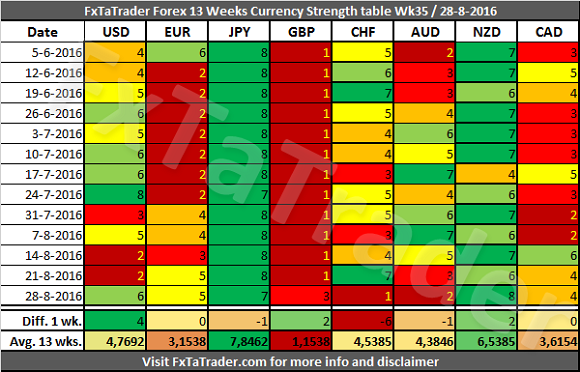

Welcome to my “Strength and Comparison” article for the coming week. For analyzing the best pairs to trade looking from a longer term perspective the last 3 months Currency Classification can be used in support.This was updated on 7 August 2016

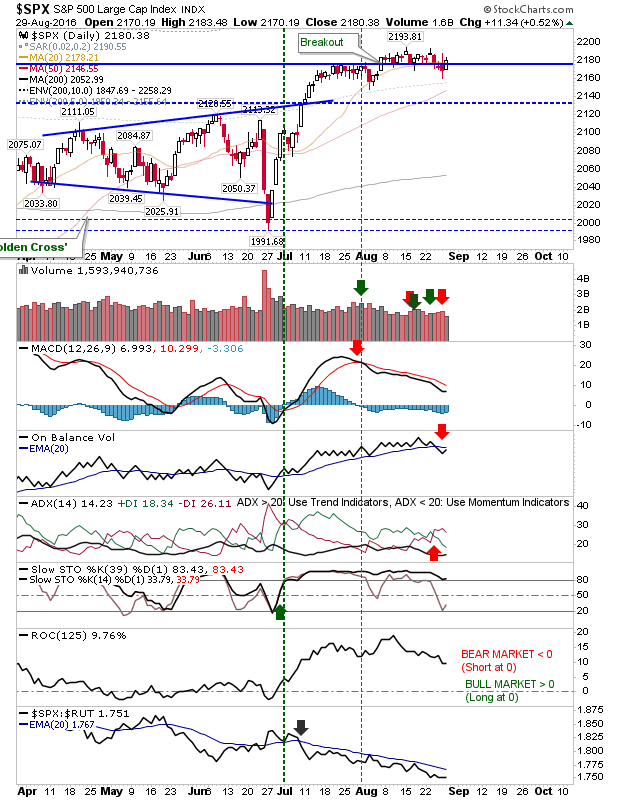

August 29, 2016