With the Jackson Hole drama behind us, US equity indexes had a good day today. Our benchmark S&P 500 popped up in the opening 15 minutes and then gradually rose to its 0.67% intraday high in the early afternoon. The final two hours of trading trimmed the gain to 0.52%. Today’s advance snapped a modest three-day sell-off.

The yield on the 10-year note closed at at 1.57%, down five basis points from the previous close.

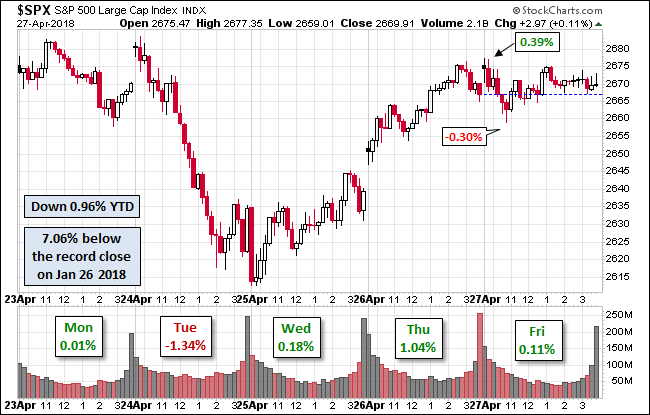

Here is a snapshot of past five sessions in the S&P 500.

Here is daily chart of the index. A preliminary read on the today’s volume came in at its 2016 low.

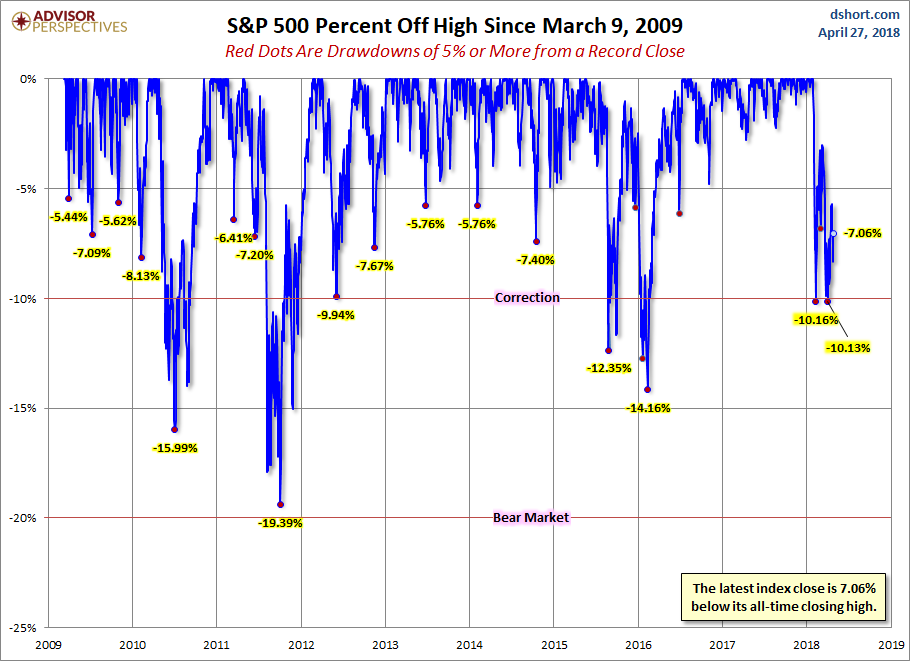

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

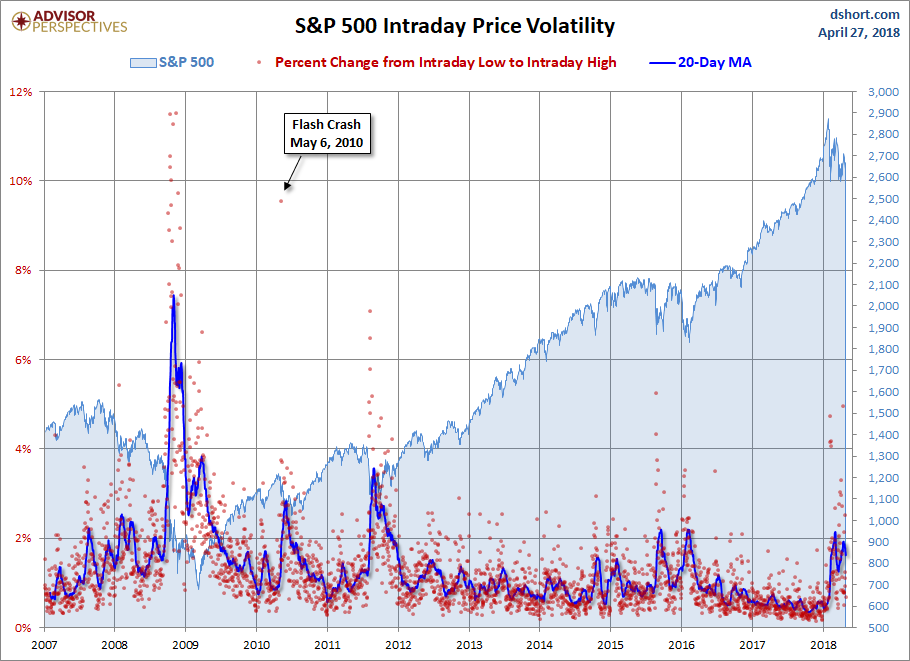

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

Leave A Comment