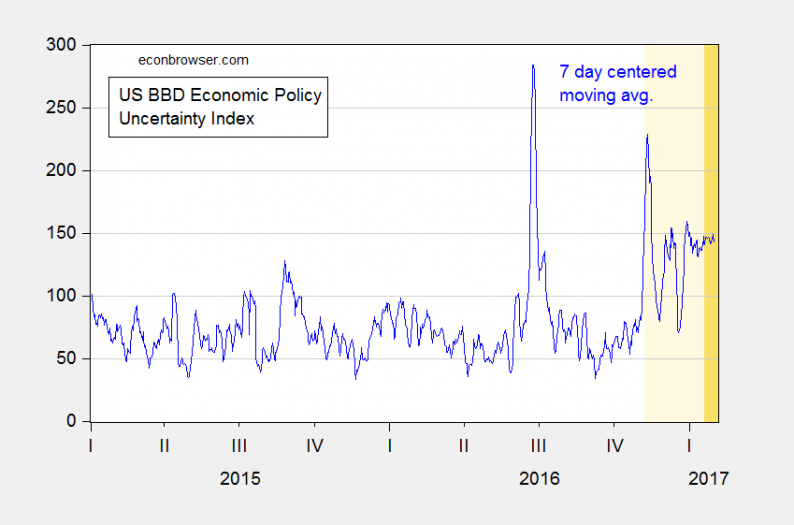

Economic policy uncertainty as measured by the Baker, Bloom, Davis news-based index is definitely higher than pre-election. Here is the daily data, since the beginning of 2015: Figure 1: 7 day centered moving average of Economic Policy Uncertainty Index (news-based), as

February 5, 2017