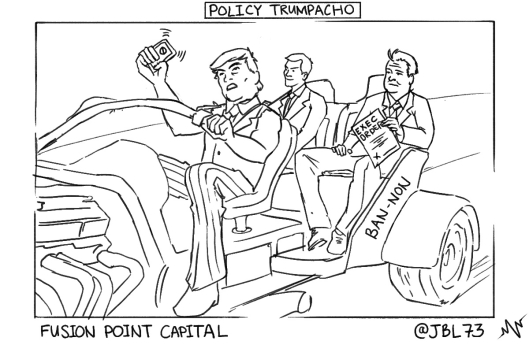

The S&P is up 8% since the election. Volatility has been squashed. The VIX is near record lows. Jason Leach at Fusion Capital credits “Policy Trumpacho“.

This is a guest post by Jason Leach with minor editing and a few new subtitles.

Policy Trumpacho: It’s Digital

There has been much talk on the TV these last few months: (i) how valuations don’t matter, (ii) how it is about sector rotation, and (iii) how making America great again is going to unleash financials, industrials, materials, energy, etc.

I’ve read fundamental and technical research and attended conferences with virtually no mention of potential downside. How could there be when everything is “breaking out” (healthcare be danged) and a cursory glance at the omniscient forward multiple on the S&P 500 is barely above the historical 16.5x mean, at a warm porridge just right 18x.

Furthermore, it is argued, that since we have moved from dirty to digital, from smokestacks to server racks, margins have expanded and rendered useless any historical comparison of today’s valuation multiples to the 1980s or aghast, the dirty 1960s-1970s – pre-steroid era…pre-concussion protocol…hide yo kids, hide yo wife…they’re canceling CFA Level II study courses around here…

In the mid-60s, at the height of “dirty”, U.S. profit margin from current production hit 14% (with a trailing P/E of 18x). It declined to a low of 7% in the late ‘80s (P/E of 18x), rose to 14% in 2006 (P/E of 18x), declined substantially during the crisis, and is 14% as of 3Q16 (but with a P/E of 22x). The profit margin trend has no doubt been up since computerization in the 1990s, but cyclicality remains. So, “digital” profit margins today are the same as they were 10 years ago, before the iPhone, and the same as 50 years ago, before Apollo 11 landed a man on the moon with processing power less than an iPhone. The difference is the price paid today for those margins is 20% higher. I get it, this time is different because it’s not different.

Leave A Comment