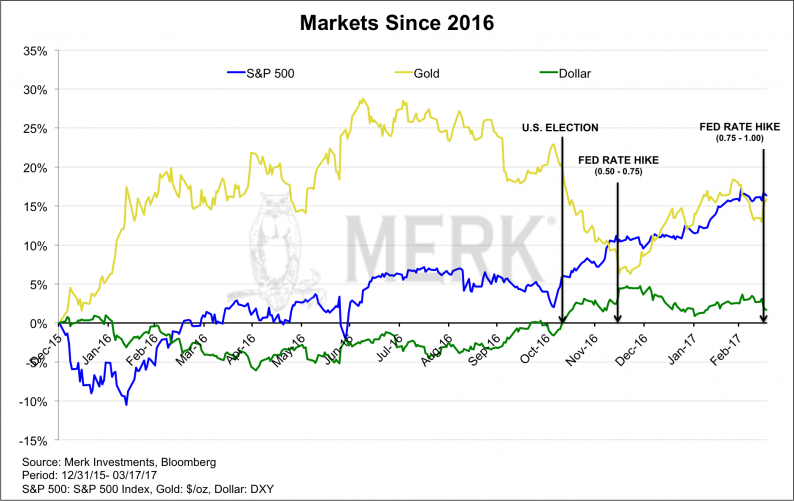

Written by John Szramiak/Vintage Value Investing The Federal Reserve Board met last week and raised interest rates by 25 basis points (0.25 percentage point). The case for a hike was strong: We’re at more or less full employment. Inflation, which has slowly accelerated,

March 22, 2017