Two rate hikes since last year have weakened the dollar. Why is that, and what’s ahead for the dollar, currencies & gold? And while we are at it, we’ll chime in on what may be in store for the stock market…

Stocks…

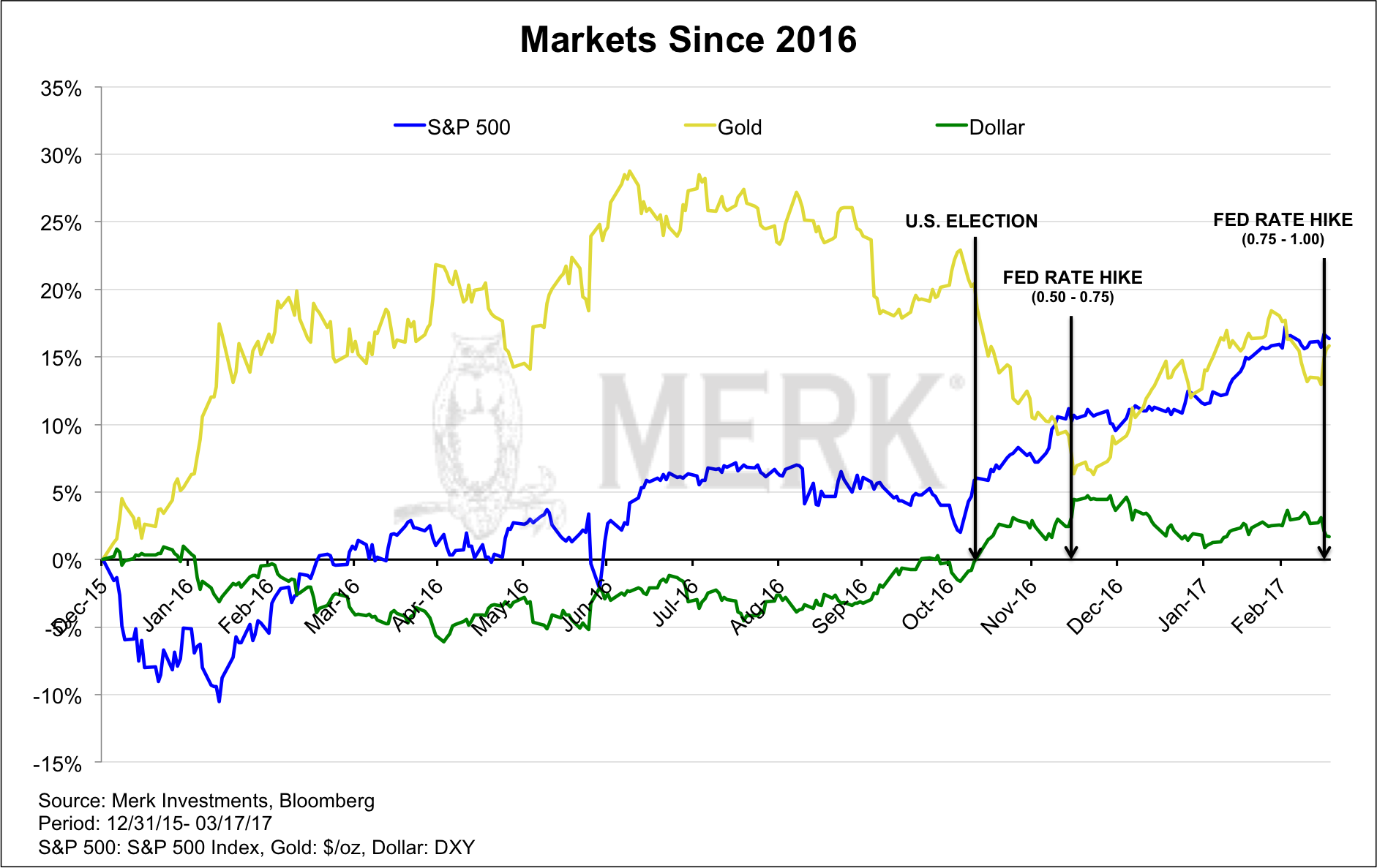

The chart above shows the S&P 500, the price of gold and the U.S. dollar index since the beginning of 2016. The year 2016 started with a rout in the equity markets which was soon forgotten, allowing the multi-year bull market to continue. After last November’s election we have had the onset of what some refer to as the Trump rally. Volatility in the stock market has come down to what may be historic lows. Of late, many trading days appear to start on a down note, although late day rallies (possibly due to retail money flowing into index funds) are quite common.

Where do stocks go from here? Of late, we have heard outspoken money manager Jeff Gundlach suggests that bear markets only happen if the economy turns down; and that his indicators suggest that there’s no recession in sight. We agree that bear markets are more commonly associated with recessions, but with due respect to Mr. Gundlach, the October 1987 crash is a notable exception. The 1987 crash was an environment that suffered mostly from valuations that had gotten too high; an environment where nothing could possibly go wrong: the concept of “portfolio insurance” was en vogue at the time. Without going into detail of how portfolio insurance worked, let it be said that it relied on market liquidity. The market took a serious nosedive when the linkage between the S&P futures markets and their underlying stocks broke down.

I mention these as I see many parallels to 1987, including what I would call an outsized reliance on market liquidity ensuring that this bull market continues its rise without being disrupted by a flash crash or some a type of crash awaiting to get a label. Mind you, it’s extraordinarily difficult to get the timing right on a crash; that doesn’t mean one shouldn’t prepare for the risk.

Bonds…

If I don’t like stocks, what about bonds. While short-term rates have been moving higher, longer-term rates have been trading in a narrow trading range for quite some time, frustrating both bulls and bears. Bonds are often said to perform well when stock prices plunge, but don’t count on it: first, even the historic correlation is not stable. But more importantly, when we talk with investors, many of them have been reaching for yield. We see sophisticated investors, including institutional investors, provide direct lending services to a variety of groups. What they all have in common is that yields are higher than what you would get in a traditional bond investment. While the pitches for those investments are compelling, it doesn’t change the fact that high yield investments, in our analysis, tend to be more correlated with risk assets, i.e. with equities, especially in an equity bear market. Differently said: don’t call yourself diversified if your portfolio consists of stocks and high yielding junk bonds. I gather that readers investing in such bonds think it doesn’t affect them; let me try to caution them that some master-limited partnership investments in the oil sector didn’t work out so well, either.

Leave A Comment