Divisions. Divisions. Divisions. Divisions. They’re everywhere and they’re deeper than ever. Such are the times. It was like this when the civil rights movement reached fever pitch in the 1960s.In and around that same time frame Cubans experienced similar divisions

June 8, 2017

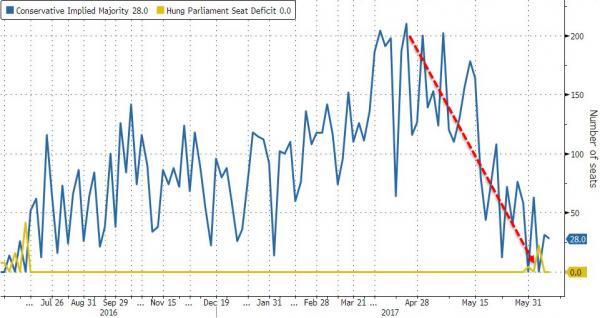

While stock markets remain comfortably numb to any and every potential (and actual) geopolitical earthquake, FX markets are getting very anxious… Polls showing the Conservative Party has lost its comfortable lead have increased uncertainty over today’s U.K. election and investors are now paying the price.