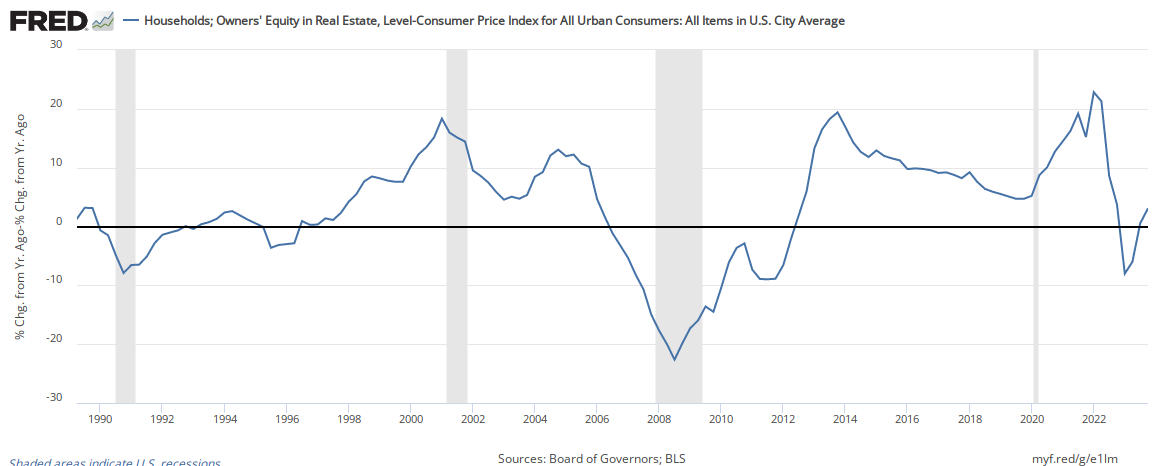

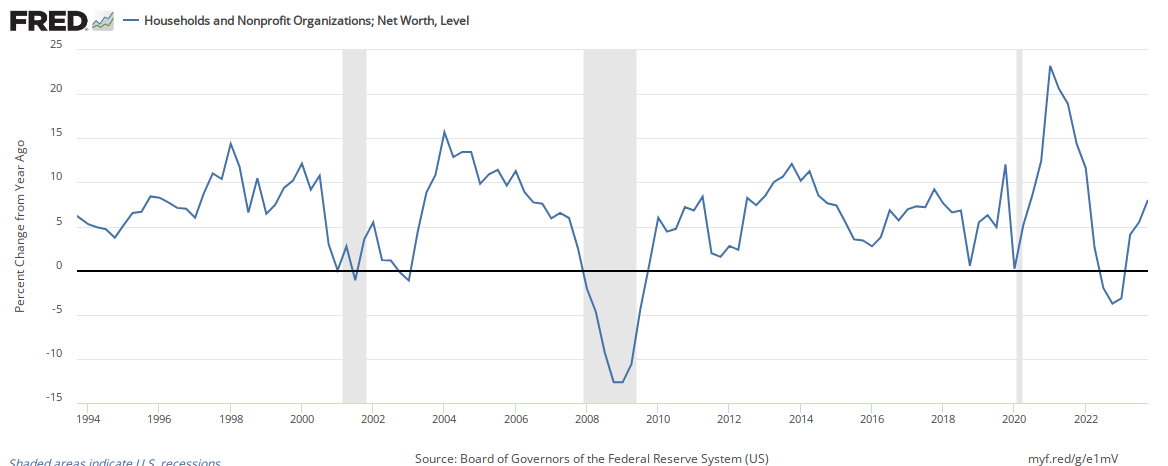

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows improvement in average household net worth. Our modeled “Joe Sixpack” – who owns a house and has a job, and essentially no other asset – is better off than he was last quarter (but his growth rate of improvement continues to decline).

Analyst Opinion of the Joe Sixpack and Middle Man Indices – Z.1 Flow of Funds

One should worry about the 35% of Americans who do not own any financial asset. Z.1 Flow of Funds net worth data is not inflation adjusted. and

Food for thought [from the data in the Z-1 Flow of Funds]:

You may ask why this analysis is important? It looks at the financial health of the consumer – and in a consumption based economy, it measures the dynamics affecting the consumer.

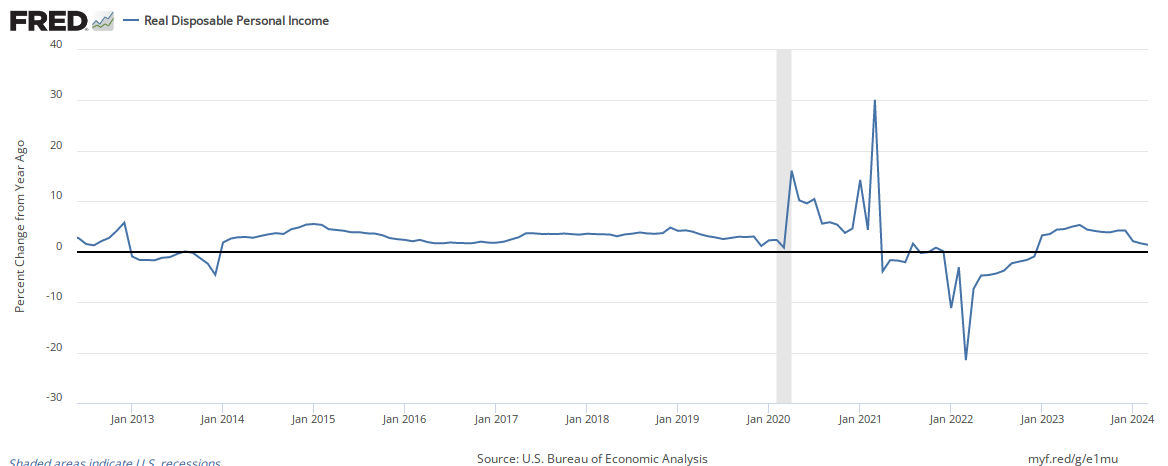

35% of Americans who own no home or have any other assets are no better off (living from paycheck to paycheck) – and consumption is based simply on income. The median household’s income is no better then it was 16 years ago – according to Sentier Research’s Household Income Index [click here to read analysis of the current situation]. Here is the graph from their analysis which shows that REAL household income has changed very little in the last two years.

Leave A Comment