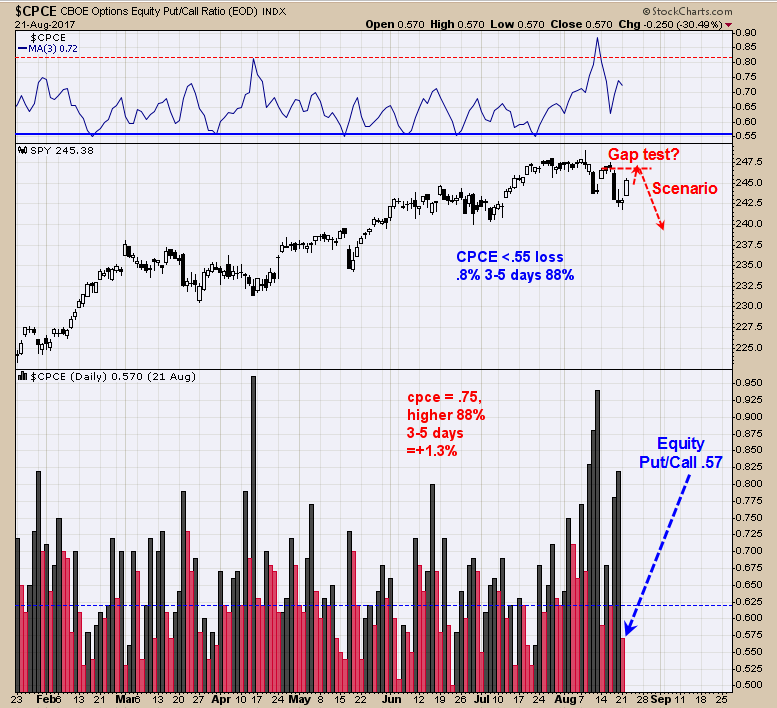

SPX Monitoring purposes; Long SPX 8/17/17 at 2430.01 Monitoring purposes Gold: Neutral Long Term Trend monitor purposes: Neutral Yesterday’s Equity Put/Call ratio (CPCE) closed at .57. Readings of .55 and less predict a lower market in 3 to 5 days

August 22, 2017