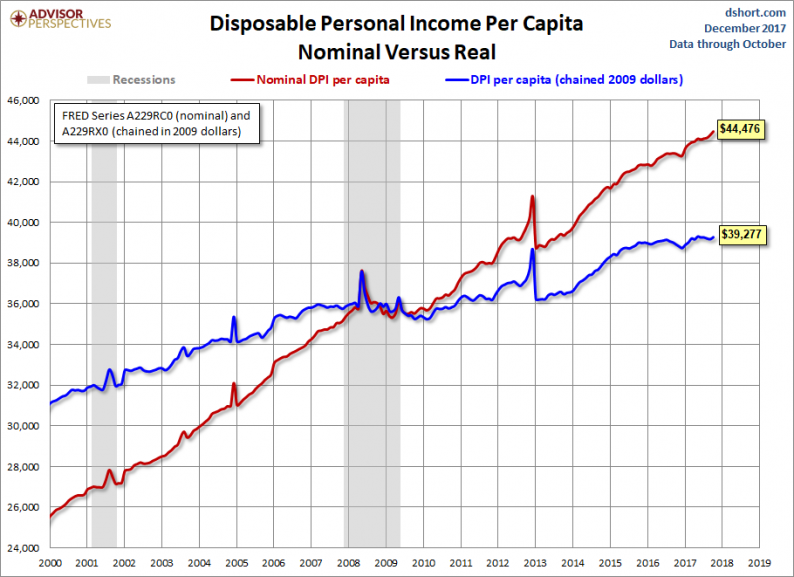

With the release of yesterday’s report on October Personal Incomes and Outlays, we can now take a closer look at “Real” Disposable Personal Income Per Capita. At two decimal places, the nominal 0.39% month-over-month change in disposable income was trimmed to

December 1, 2017