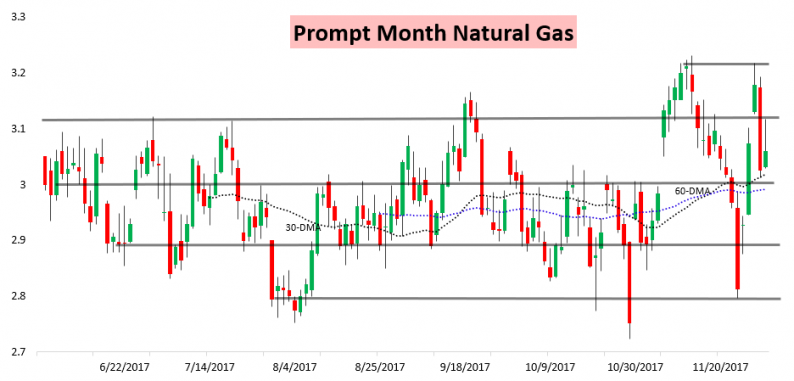

Natural gas prices settled up modestly on the day, but seemed to sputter into the weekend as most gains came overnight with prices gradually declining through the day today. Prices seemed to bounce right off the $3.12 resistance level, unable to find much of a sustained footing after 8 AM Eastern.

Part of the reason was that cash prices today were incredibly weak in the face of very strong weekend warmth that will kill heating demand.

We warned our clients about this risk in our Morning Update today after correctly identifying yesterday afternoon that overnight weather model guidance would help natural gas prices bounce off the support they tested.

Despite weak cash prices, we still saw the most gains on the day at the front of the natural gas curve.

The move in F/G today, meanwhile, showed that despite weak cash prices the market is beginning to price in colder weather risks through the middle of December.

As we head into the weekend and early next week, traders will obviously be keeping a close eye on the weather, attempting to determine just how intense any mid-month cold is. Afternoon Climate Prediction Center forecasts continued to show significant cold risks.

The American CFSv2 climate model has continued to show risks that sizable cold lingers into Week 3 as well, with some risks into Week 4 along the East Coast. This guidance is notoriously volatile, however, and both Week 3 and especially Week 4 forecasts can frequently flip rapidly.

Either way, it is clear that weather is supporting this market, and traders will certainly struggle to update heating demand expectations amid shifting weather forecasts. We work to help traders identify the risks within forecasts to determine where value along the natural gas strip exists, and provide hypothetical trade alerts to translate our weather-driven analysis into actionable content. This week we issued two Trade Alerts which executed a profitable trade; Trade Alerts are published when there is an especially high confidence opportunity to take advantage of weather-driven mispricing in the natural gas market. We have averaged one a month over the past four months, and each one has proven profitable.

Leave A Comment