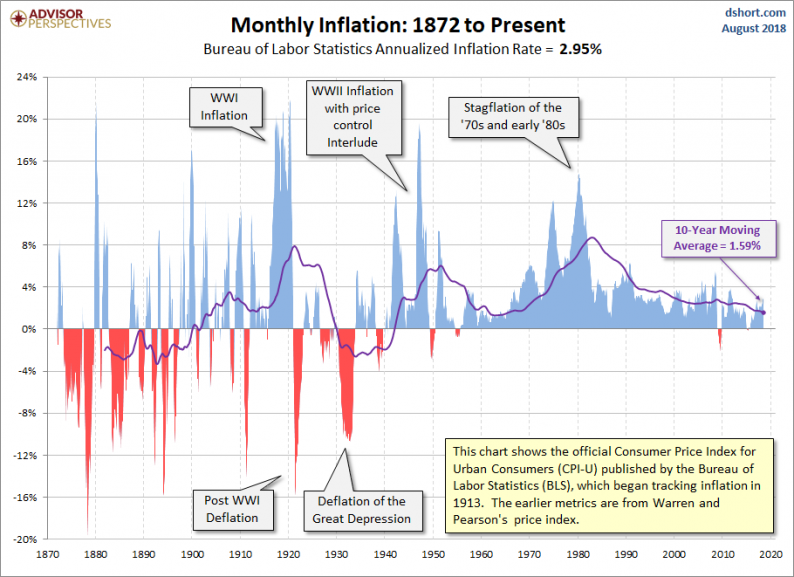

Inflation could be the most important metric to follow because if it gets too high, the Fed will need to accelerate rate hikes which could cause a yield curve inversion and later a recession. One very important thing to keep

August 13, 2018

The Barchart Chart of the Day belongs to the retail apparel stock American Eagle Outfitters (AEO). American Eagle Outfitters, Inc. is a leading global specialty retailer offering high-quality, on-trend clothing, accessories and personal care products at affordable prices under its American Eagle Outfitters and