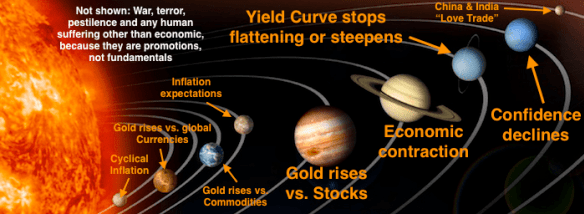

Why is gold failing to rise as stocks around the world fall? I think it may be because there are too many alternatives which are more fun than boring heavy metal: cryptocurrencies, cannabis shares, and even oil stocks. They are roller

October 26, 2018