Lack of conviction in this market has, ironically, contributed to how long it perseveres with rotational moves holding the S&P up; even though there is the risk that it’s only trying for a secondary test of the January highs. Of course that’s the charts; the Chinese ‘resolve’ against a trade deal weighs on the markets increasingly; and its resolution won’t be seen on charts.

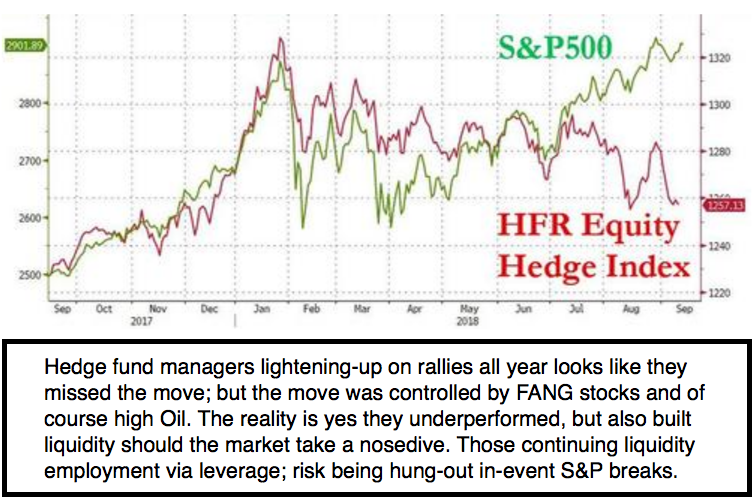

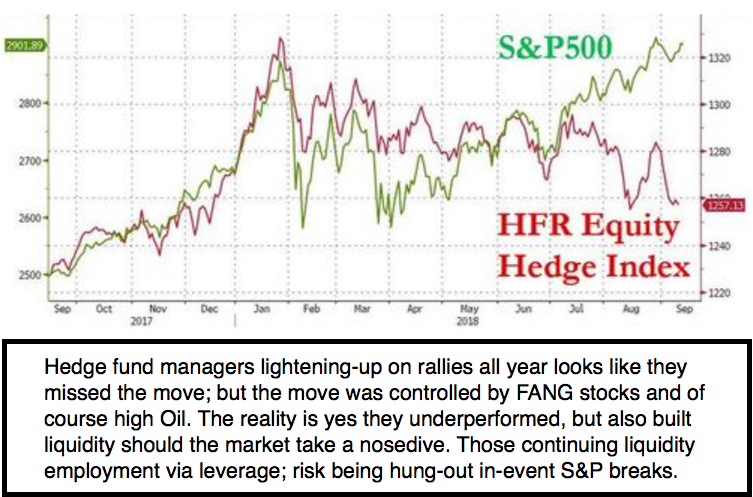

For months we have listened to consistent detrimental assessments of the market by a few technicians and many hedge managers. Also, ironically, because we concurred about the risk, one notable difference in our views, was that we declined temptations to fully liquidate much less short-sell the market; while not being enthused about the rallies either. I warned back in January that it was a parabolic trend completion; but after the projected break in early February; that we’d have a series of rotations; not crash.

Partially it’s because we didn’t see the picture quite as glib as so many did; and because the market’s DNA allowed ‘leverage’ to run-in short-sellers; a repetitious pattern of churn without meaningful break. And there is not only the effect of the Fed increasing rates slowly; but the idea that a trade deal with China may not be as elusive as so many believe.

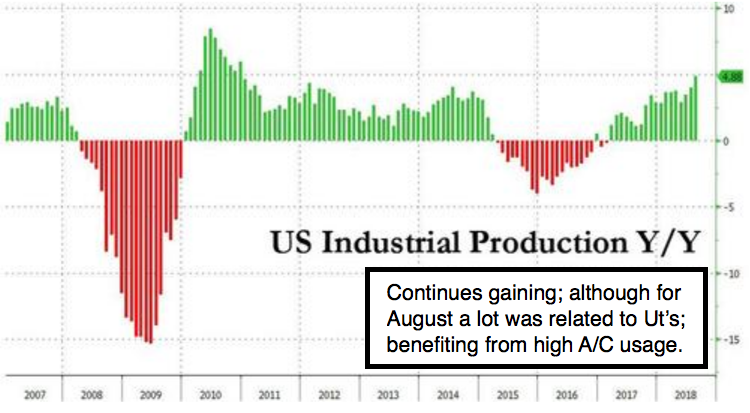

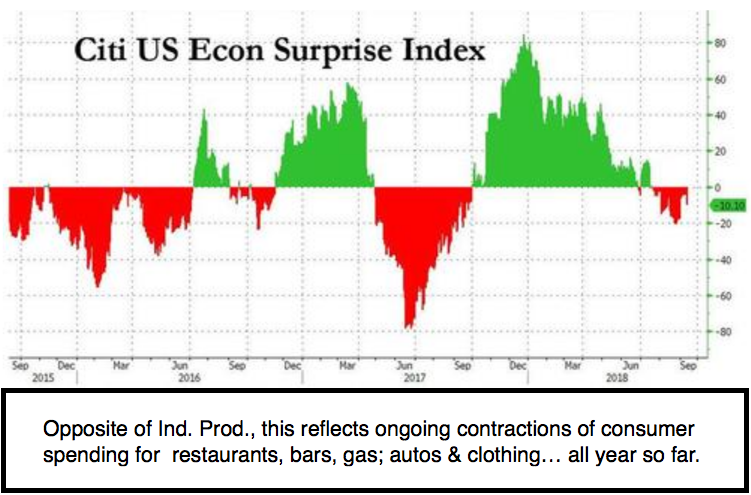

For the moment, the tariffs are having more impact on US manufacturing, it seems, than on China; which is part of why they’ve not been motivated to make a deal with us. The other reason, as a member described, is China’s desire to entirely stand on its own; which they want (for sure); but the other side of the coin is that they’re not strong enough to do it. They are not in a mood to ‘cave’ to the U.S.; and pride comes in too.

So the U.S. comes forth; and tries to leverage pressure with new tariffs; at the point where it may actually be fully-implemented before a deal occurs; which we would still like to see. Don’t get a deal yields a ‘catalyst’ to break the S&P at some point; and that’s something I’ve tried to emphasize; while believing that getting a deal won’t do much aside a nominal leg higher for the short-run; though certainly could help deflect a ‘recession’ out there.

Leave A Comment