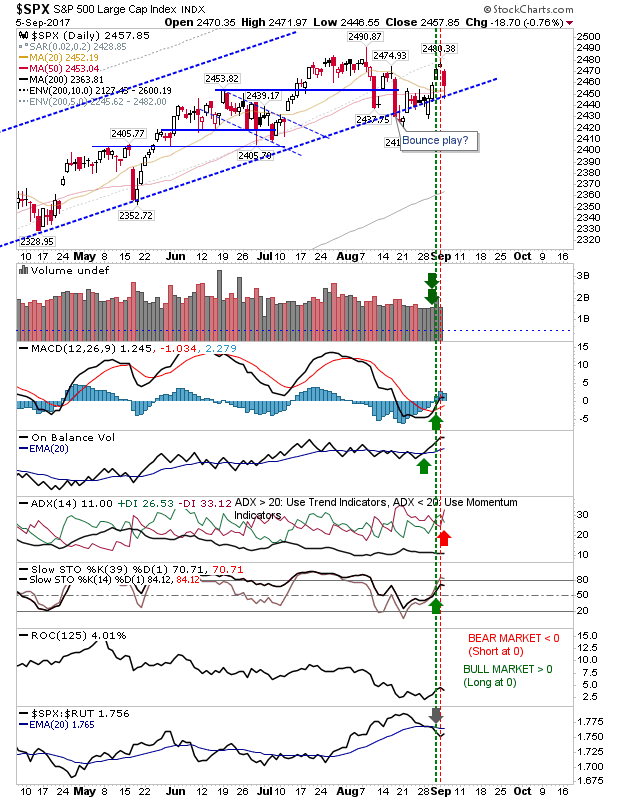

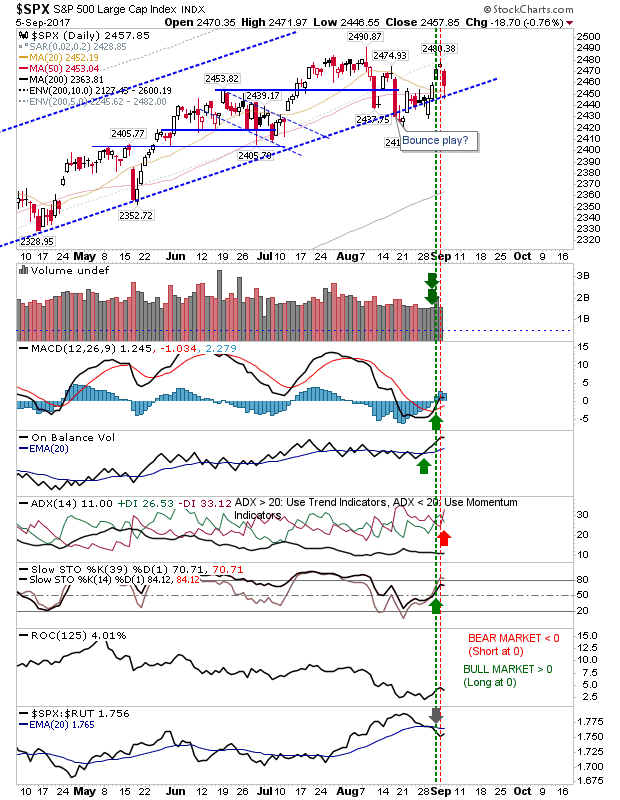

Friday’s tight action plus a long weekend of North Korea news left traders skittish and wanting out. However, there wasn’t a significant break of support to suggest a rout is imminent but further losses need to be watched.

The S&P is resting on rising support but the nature of today’s candlestick is not one to suggest tomorrow won’t see some follow through lower. The question is whether it will have enough to return above support by the close of business.

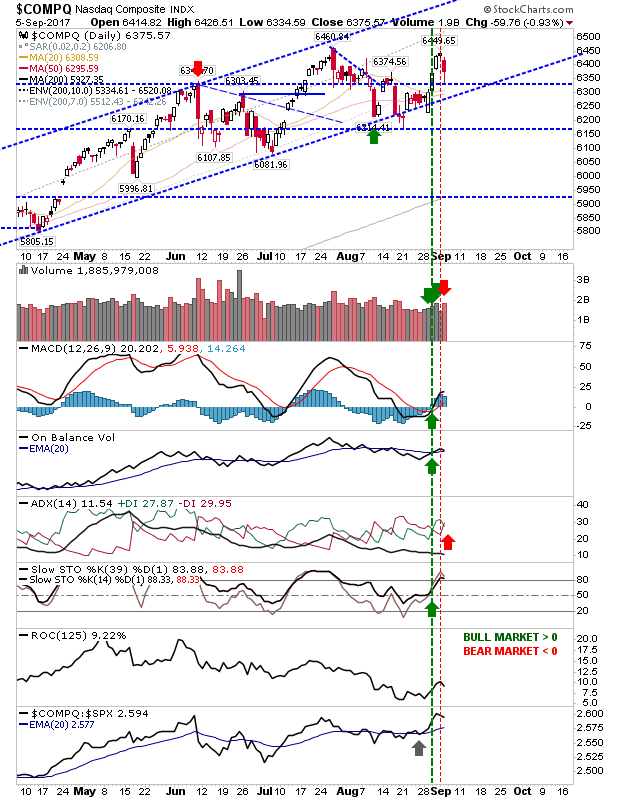

The Nasdaq is holding to a higher support level and was able to regain half of what it lost. It has two support levels to work with which gives GTC buy-order ‘fisherman’ two chances to catch a cheap fill (risk measured on a loss of 6,175).

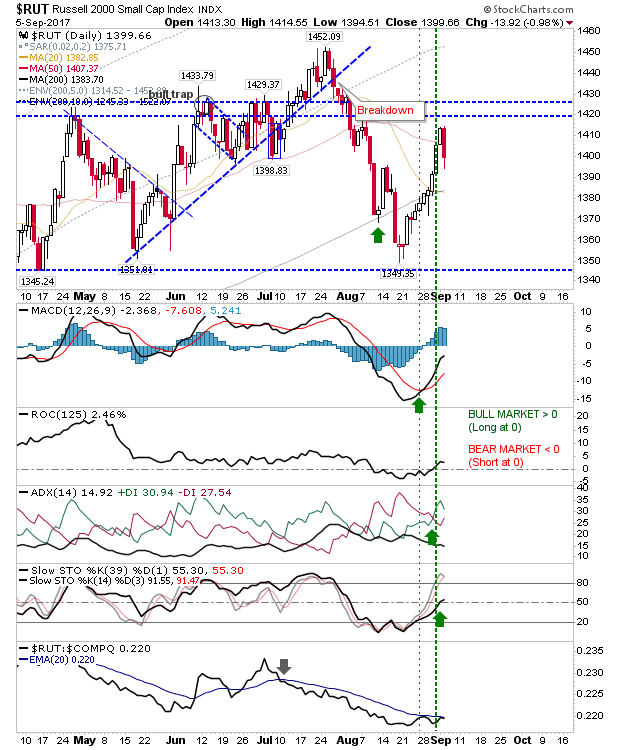

The Rusell 2000 took a larger hit which was really an artifact of the rally. I would look to the 200-day MA for bounce opportunities as another one or two days of selling could follow from today. Stick some GTC ‘buy’ orders around the 200-day MA and see what happens.

Watch morning action for leads; a gap higher may spark enough to reverse all of today’s losses but if there is no recovery then confidence could quickly slip and sellers will have control for the whole day. Based on today my expectation is for lower prices.

Leave A Comment