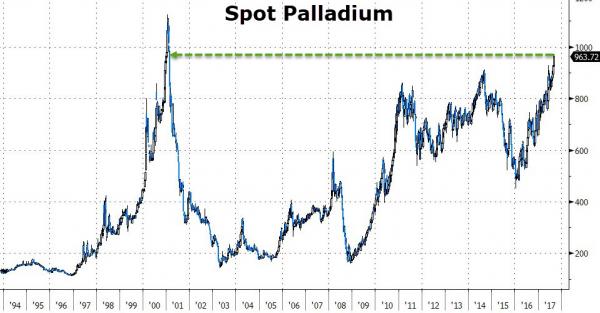

Amid hope for reinvigorated auto production (after Hurricane Harvey’s destruction) and Thursday’s escalation in US-Russia tensions (Russia being the world’s largest producer), spot Palladium was spiking on Friday, hitting its highest since record highs in January 2001.

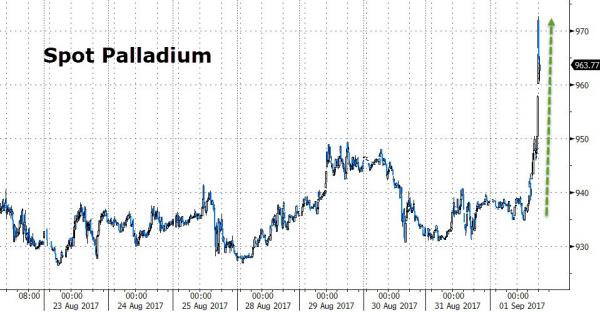

While the entire gamut of industrial and precious metals have been rising recently (the latter on the back of Chinese demand hype), Palladium prices exploded today out of nowhere (biggest jump in 7 months).

Pushing the precious metal to its highest in 16 years…

There appear to be a few catalysts for the recent trend and Friday’s spike…

1. China’s commodity panic-buying trend

There just appears to be blind panic-buying momentum from China in any and every industrial metal and along with gold prices surging amid North Korea and debt ceiling drama, we suspect Palladium is catching a bid on the back of that.

2. Renewed hopes for growth in the auto sector

As Bloomberg notes, approximately 67 percent of palladium produced is used in catalytic converters, which convert up to 90 percent of the harmful gases in automobile exhaust to less noxious substances. Global auto sales, up 4 percent for the year, are driven by a global increase in SUV sales, the ongoing shift from diesel to gasoline engines in Europe (diesel engines alternatively use platinum), and tightening emission legislation.

Sales of autos fueled by petroleum have been particularly strong in China and India. According to Jeffrey Christian, managing partner of CPM Group, car sales in China have been “borrowed” from future years through the offering of rebates and tax cuts. In the first half of the year, auto sales in China rose 4.3 percent, to 13.4 million units, from a year earlier.

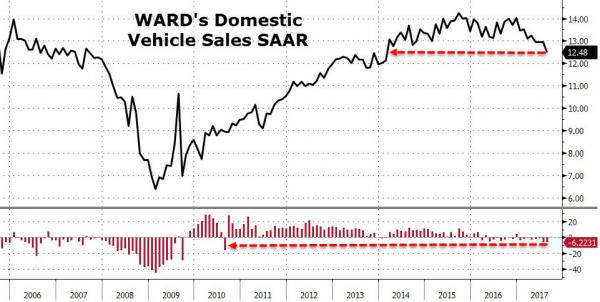

US Auto sales just collapsed though…

ZH: And the recent devastation caused by Hurricane Harvey is prompting companies like Ford to discuss increasing production once again.

Leave A Comment