We have been using the Semis as a one of several economic signposts, and as an investment/trading destination since the Semi Equipment ‘bookings’ category in the Book-to-Bill ratio began to ramp up several months ago. But those who say that Semiconductors are subject to pricing pressures are correct. It is a segment in which people need to be discrete with their investments.

Semiconductor Sector

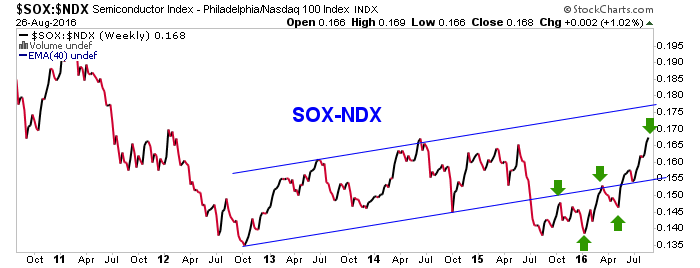

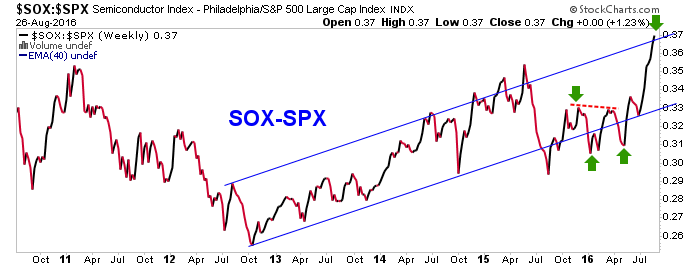

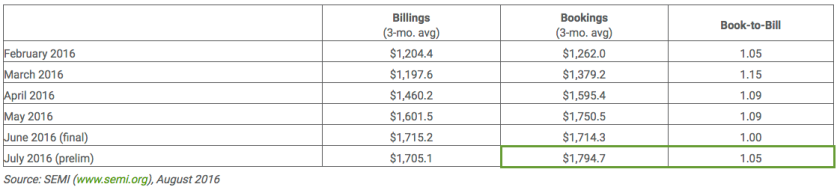

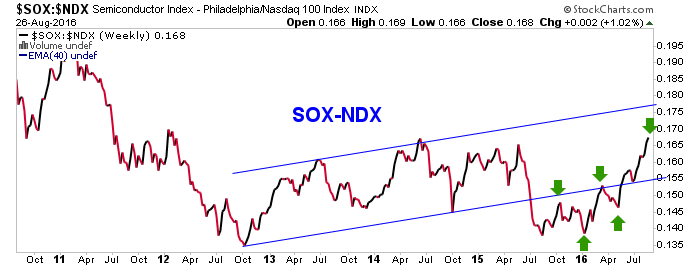

Semi has been a leader for our overall market and economic view, which has been bullish since noting that a trend of three straight months of increased bookings was established in April. The Book-to-Bill for July came in strong once again, with a new high in the key ‘bookings’ category.

From SEMI: “Monthly bookings have exceeded $1.7 billion for the past three months with monthly billings trending in a similar manner,” said Denny McGuirk, president and CEO of SEMI. “Recent earnings announcements have indicated that strong purchasing activity by China and 3D NAND producers will continue in the near-term.”

China? That does not sound like a long-term, stable fundamental underpinning. This Semi ramp up may be relatively selective (aside from Chinese demand, which could cut out at any time, it would pay to focus on 3D NAND).

From Market Realist: “Applied Materials’ (AMAT) strong guidance for fiscal 4Q16 reflects the overall semiconductor industry’s health. AMAT revised its forecast for 2016 WFE (wafer fab equipment) spending from flat to single-digit growth. The slight growth would be driven by a 40% YoY (year-over-year) increase in 3D NAND spending and a 5%–10% YoY increase in foundry spending. However, this growth would be partially offset by a 25% YoY decline in DRAM (dynamic random access memory) spending and a slight decline in logic spending. In 2016, AMAT is witnessing a broader mix of foundry customers from different geographies, especially China.”

Leave A Comment