The market finally started to show some stability towards the end of last week with sessions Thursday and Friday feeling like normal trading days for 2015; the S&P 500 traded in a tight trading range with none of the wild swings we saw during the last couple weeks. Monday also felt like a normal trading day even as stocks gave back most of Friday’s gains. It was nice to see some normalcy return to equites as over the past 6-8 weeks, the market has seen a substantial uptick in volatility with huge intraday moves occurring way too frequently.

The recent turmoil in equities has hastened the first “correction” for the market since 2011. This has triggered a warning from Nobel Laureate economist Robert Shiller saying recent investor surveys are showing more fear that the market is substantially overvalued than at any time since the dotcom bubble of 2000.

The high beta biotech sector has started to recover in recent weeks after almost dropping 20% from previous highs and thus avoiding an official “bear” market. If the Federal Reserve decides to punt on raising interest rates for the first time since 2006 on Thursday, this should be supportive of the “risk on” areas of the market including biotech.

Most of the new money I am allocating into the biotech sector of the market anytime the overall market declines continues to be marked for blue chip large cap growth stocks within the industry such as Amgen (NASDAQ: AMGN) and Gilead Sciences (NASDAQ: GILD). However, if the central bank stands pat on rates I will get a bit more adventuresome in the space. Embracing a more optimistic tone, here are a couple of promising small cap biotech concerns worth consideration by aggressive growth investors within this lucrative but volatile part of the market. Each stock goes for south of $5.00 a share.

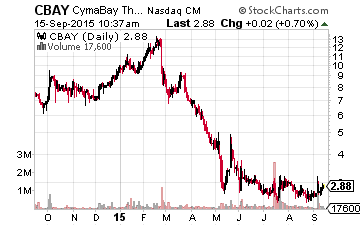

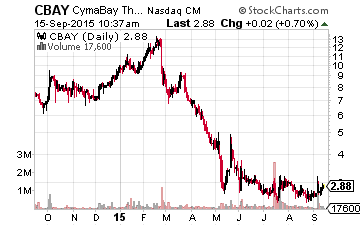

Let’s start with Cymabay Therapeutics (NASDAQ: CBAY), a small biotech concern with a market capitalization of approximately $65 million and a stock price that is currently just under $3.00 a share. I picked up a small stake early in the summer after the stock tumbled over 75% after a disappointing Phase IIb trial for its main drug candidate arhalofenate.

Let’s start with Cymabay Therapeutics (NASDAQ: CBAY), a small biotech concern with a market capitalization of approximately $65 million and a stock price that is currently just under $3.00 a share. I picked up a small stake early in the summer after the stock tumbled over 75% after a disappointing Phase IIb trial for its main drug candidate arhalofenate.

Leave A Comment