“Patience, persistence and perspiration make an unbeatable combination for success.” – Napolean Hill

The fourth quarter has certainly gotten off to an interesting start. The first two days of trading saw stocks plunge in the early hours only to claw their way back by the close of the market. Friday’s Jobs Report was disappointing to say the least. Not only did the report come in approximately 60,000 jobs short but there were major revisions down from the previous two months’ numbers. It seems the domestic economy cannot escape the effects of weak global demand and a strong dollar. Manufacturing was particularly weak.

On the bright side, the latest punk job numbers in all probability will put the Federal Reserve on the sidelines for raising rates for the first time since 2006 until at least 2016. This should also mean less chance the dollar will rise further against major currencies and might even give back some of its gains this year. On the margin, this should be positive for energy and commodity prices and should lessen pressure on the profits of most of the S&P 500.

After the worst quarter for stocks in four years, I believe it appears equities are trying to find a bottom based on the events of the last three months. Therefore, it might be time to do some bottom fishing. There are several stocks that have gotten way too cheap during the recent downturn in the stock market and look ready to bounce. Here are two that look like good bets going forward.

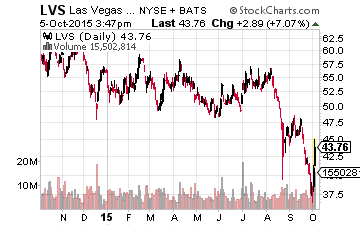

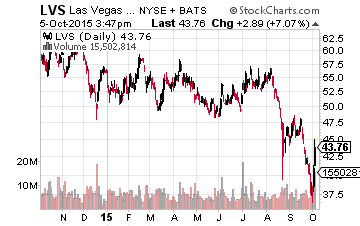

Let’s start with Las Vegas Sands (NYSE: LVS), the American casino operator that gets the vast majority of its revenues and earnings from Asia; primarily the gambling enclave of Macau. Like all casino operators in Macau, the stock has been hit hard by the drop-off in traffic in 2015. Chinese authorities had cracked down on “corruption” which severely affected how many high rollers showed up in Macau.

Let’s start with Las Vegas Sands (NYSE: LVS), the American casino operator that gets the vast majority of its revenues and earnings from Asia; primarily the gambling enclave of Macau. Like all casino operators in Macau, the stock has been hit hard by the drop-off in traffic in 2015. Chinese authorities had cracked down on “corruption” which severely affected how many high rollers showed up in Macau.

The sector got a huge lift last Friday and was one of the best performing areas in the market that day as it appears Chinese leadership is beginning to realize it has overstepped, causing a steep drop in economic activity and job growth in Macau. The stocks of these operators received a huge boost after Beijing’s top official in the region gave a clear sign Friday that support from the government could be on the way.

Leave A Comment