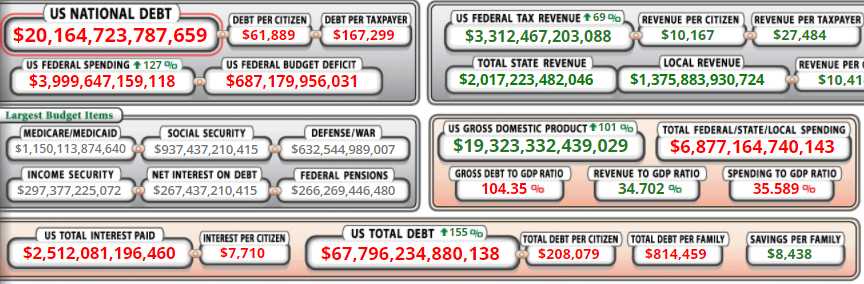

Dow 22,000, S&P 2,500, Nasdaq 6,000, Russell 1,420 and National Debt $20Tn.

It’s an interesting combination. American’s also have $18.5Tn in personal debt, that’s been climbing at a rate of about $500Bn per year this century (up 124% since 2000) and accounts for 2.5% of our GDP, which is growing at less than 2% so the ENTIRTY of our economic growth is debt-financed. Even more so because our Government is going $1Tn per year into debt too, that’s 5% of our GDP ($19.3Tn) in Government debt and that does not include the $500Bn a year the Fed has been adding to its balance sheet through the continuing QE program – that’s another 5%.

So, 12.5% of our MAYBE 3% GDP growth is nothing more than deficit spending which means the real economy is DOWN 9.5% if, like Greece, we were forced to balance our budgets. Of course, balancing our budgets is out of the question because your share of the National Debt is $208,079 and, if you have a family, we’re looking over $800,000 just to pay off your Government’s share – before you even begin to do something about your own mess.

Logically then, this debt is uncollectable. Most people don’t have $800,000 and aren’t likely to get it in the near future. Even if we made the Top 10% pay 10x, that’s “$8M” for our top 1M families, which would be $8Tn but only the Top 0.01% have that kind of money and good luck getting President Trump to pay that bill!

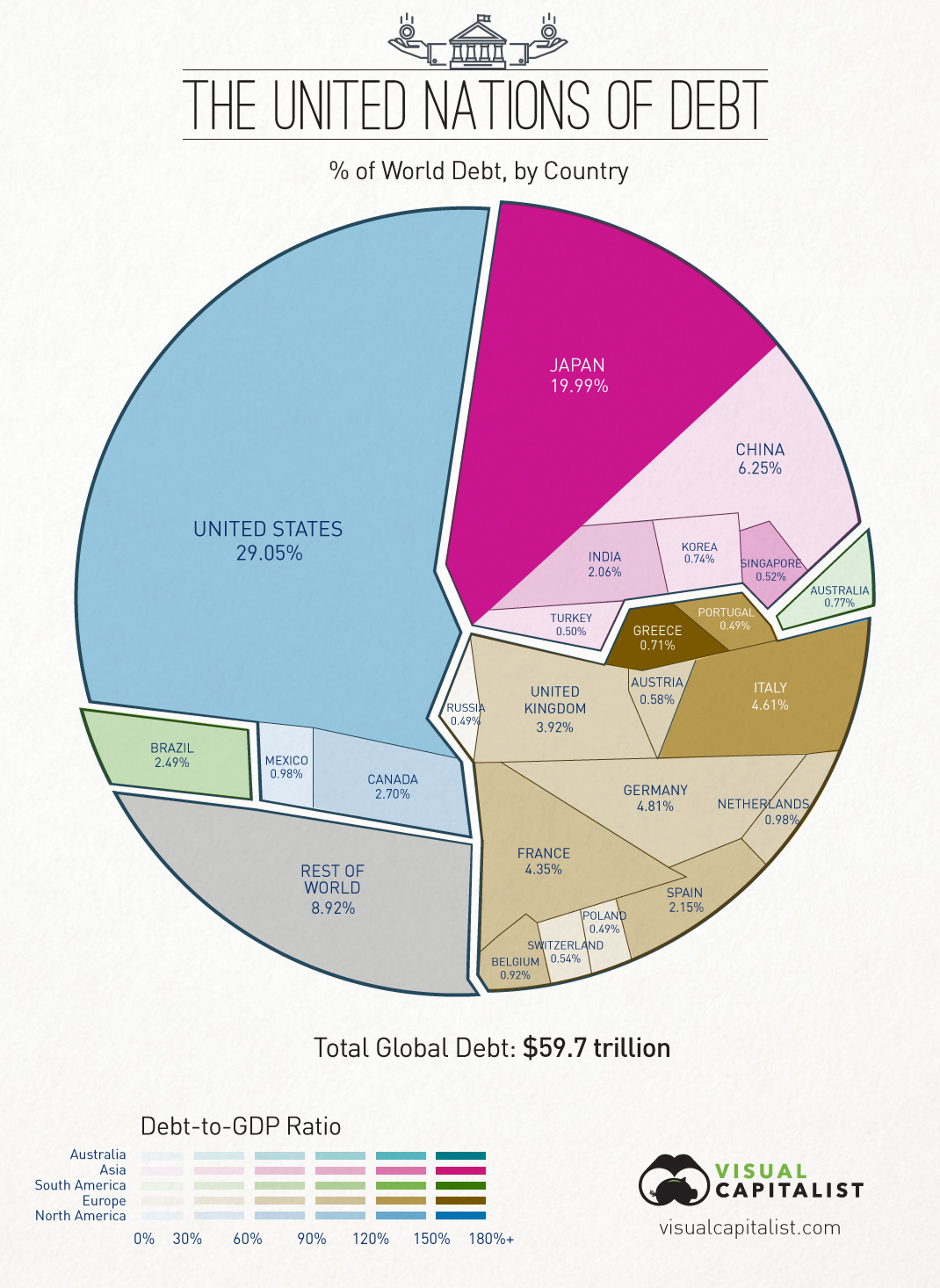

Where is the end game here? And it’s not just the US, of course. In fact, our debt to GDP ratio is a relatively calm 104% while China and Japan are in the 250% debt to GDP range though, “officially“, China doesn’t have much debt – which makes it much scarier when they are in denial.

What can’t be denied is that the US has 29% of the World’s debt and we’re also about 25% of the World’s GDP – so not completely out of proportion but it’s still a huge problem for Global Lenders. Japan is really out of control, holding 20% of the World’s debt against 6% of the GDP.

Leave A Comment