Shareholder Activism

2016 is set to be a busy year for shareholder activists according to FTI Consulting’s Activist Insight Survey. The survey quizzed 24 activist firms that have engaged in more than 1200 activist events, some of which have been the largest and most high-profile activist situations of the past year.

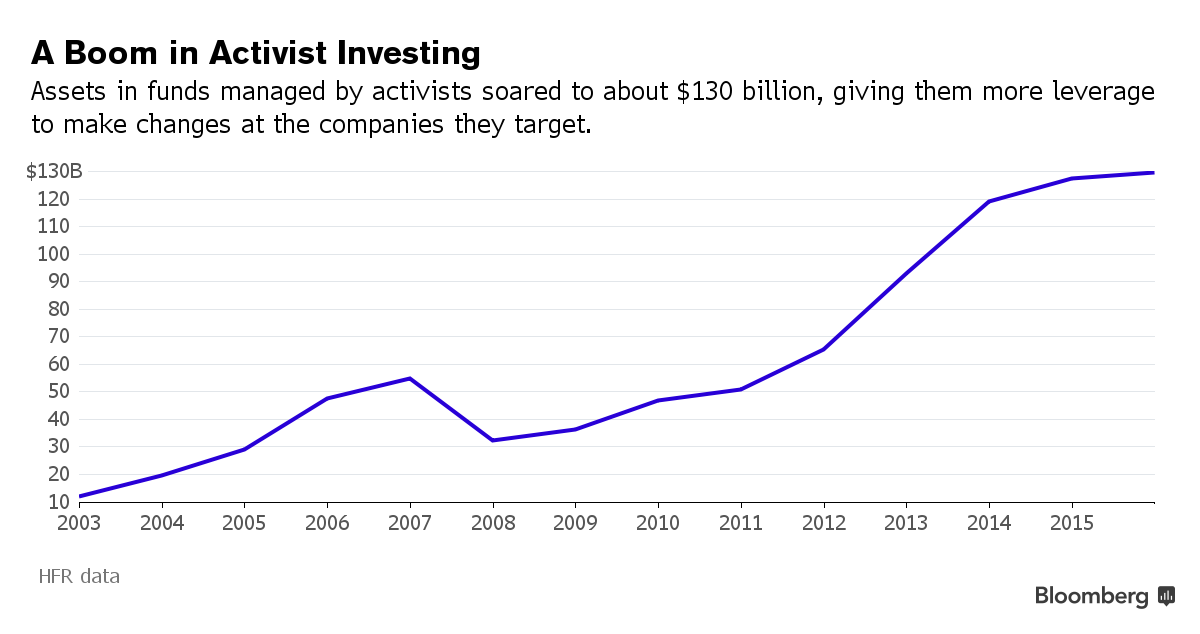

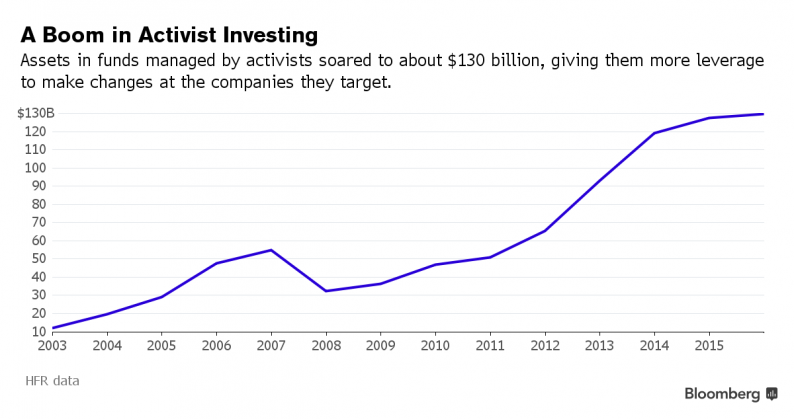

Shareholder activism id booming

Respondents to the activist insight survey indicated that the energy sector will see the most activist activity next year, and most activists believe the best activism targets are not Mega-Cap stocks, but rather micro- to mid-cap stocks. 58% of the respondents saw significant future opportunities for shareholder activism in small-cap stocks while 48% of the respondents saw limited future opportunities for shareholder activism in mega-cap stocks.

Just under half of the respondents identified Energy as the sector that is most undervalued, yielding added opportunity for gains. In contrast, 35% of investors identified Healthcare as the most overvalued.

And when it comes to the type of activism campaigns they’re expected to rise during 2016, most respondents (80%) answered that merger activism will be the most popular form of activism to take place next year. Activism aimed at either increasing consideration in an announced merger “bumpatrage” or attempting to stop an announced merger are widely perceived to be the type most likely to increase.

“Faced with a complicated economic climate, activists are looking at a number of different strategies to create value. These include forcing overpopulated markets to consolidate and focusing on operations in industries with stable revenues. This survey suggests both types of activism are likely to affect energy and industrial stocks in particular.” — FTI Consulting’s 2015 Activist Insight survey

Shareholder activism: Managements take notice

Leave A Comment