Now is the time so start broadening out your portfolio into some more defensive stock picks. Indeed, a recent report by Bank of America shows that investors are already starting to take a potential downturn very seriously. The report notes that the top five performing sectors over the last three months have all been defensive — namely, staples, utilities, REITs, health care and telecommunications.

Let’s dive in now:

1. Costco (Nasdaq:COST)

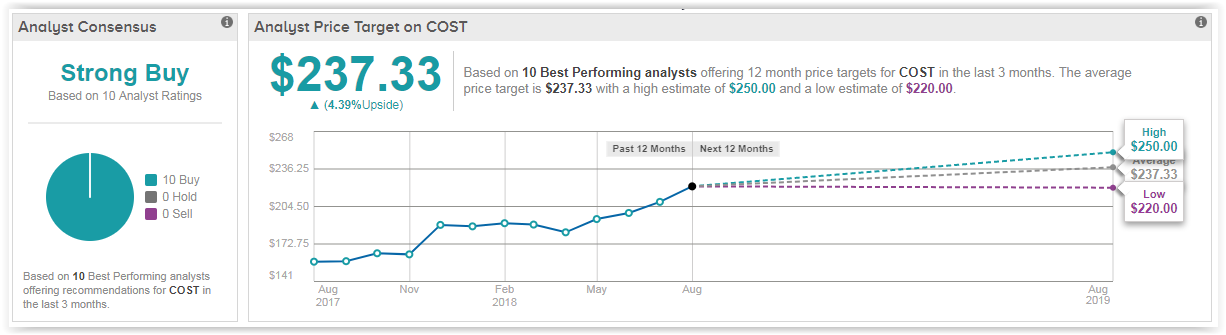

Five-star Oppenheimer analyst Rupesh Parikh (Profile & Recommendations) has just lifted his Costco price target from $210 to $250. The reason? “We believe COST remains best positioned in our entire food and grocery coverage to deliver sustainable top- and bottom-line performance” explains Parikh.

He continues: “Ongoing market share gains in the grocery category coupled with continued momentum in the company’s more discretionary offerings in a still strong consumer backdrop should help to sustain a mid-single-digit type comp trajectory.”

Most encouragingly, Parikh sees sustainable top and bottom line delivery even in a competitive retail backdrop. And it seems like the Street agrees. Right now ten analysts have published Buy ratings on the stock in the last three months.

View COST Price Target and Analyst Rating Details.

2. T Mobile US (Nasdaq:TMUS)

T-Mobile is the third-largest wireless carrier in the US. According to top Oppenheimer analyst Timothy Horan (Profile & Recommendations), TMUS has captured 100% of the industry growth since 2013. He has just reiterated his Buy rating with a bullish $90 price target (37% upside potential).

Excitingly, Horan is optimistic about the prospects of the ‘transformational’ $26 billion TMUS/ Sprint merger going ahead. He writes “we see an 80% chance of regulatory approval given the pro-consumer/investment/jobs focus that scale drives, but with concessions.”

Leave A Comment