With the advent and explosion of online financial content as well as sites dedicated to tracking insider activity like Insider Monkey, it is easier than ever to be aware of what insiders are buying and selling at their companies. It is something I peruse at least once a week to come up with new investment ideas to research further.

Here are three small cap stocks that look attractive at current levels and also have had recent insider buying. All are currently under $5.00 a share.

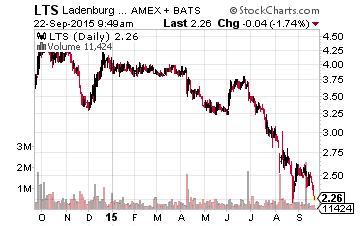

Let’s start with Ladenburg Thalmann Financial Services (NYSE: LTS). Ladenburg is one of the longest operating brokerage firms around as well one of the oldest members of the New York Stock Exchange. The company has over 4,000 financial advisors and helps firms raise capital via debt and equity offerings.

Noted billionaire and biotech entrepreneur Dr. Phillip Frost owns a decent chunk of the firm. The company has a market capitalization of just over $400 million and a stock price just below $2.50 a share. Dr. Frost and several other directors have been frequent buyers of the shares over the past few months.

Ladenburg continues to buy up smaller firms and should post revenue growth north of 25% this year. Currently, the company is posting small losses. However, when you compare it to other brokerage firms like Raymond James (NYSE: RJF), based on price to sales or to the valuation placed on assets under management, Ladenburg is deeply undervalued.

Pernix Therapeutics Holdings (NASDAQ: PTX) is next up on our interesting small cap stocks insiders are buying. This small biopharma concern has three key drugs on the market: Treximet, Silenor and the recently acquired Zohydro which treat pain and sleep disorders. The stock has been under pressure as the company lowered guidance during its last quarterly earnings call mainly as the result of the integration of the recent purchase of Zohydro, which came with its own sales force. The stock currently goes for just over $4.00 a share and the company has a market capitalization of approximately $250 million.

Leave A Comment