As we head into the final innings of 2015, the major equity indices are showing low single-digit losses for the year with the exception of the NASDAQ which is up slightly. It has been a bifurcated market for most of 2015. Unless you had a heavy dose of the FANG stocks (Facebook (FB), Amazon (AMZN), Netflix (NFLX), Google (GOOGL)), your portfolio is at least slightly underwater for the year. Of the 3000 largest stocks by market capitalization, some 65% are down 15% or more from their yearly highs as of this weekend.

Luckily, the leaders from one year rarely see their outperformance carried into the new one especially if they have stretched valuations like most of 2015’s market leadership does. With that in mind, I offer up some selections that should post some significant gains in 2016 even in a market I see being flat again overall in the New Year.

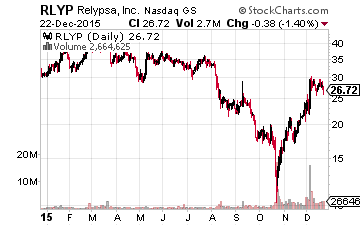

Let’s start with Relypsa (NASDAQ: RLYP), a small biopharma whose first commercialized product is just hitting the market. The name of the compound is “veltassa” which is a potassium binder that treats a widespread condition called hyperkalemia (excessive potassium in the blood). The potential annual market is projected to be some $2 billion annually.

Relypsa’s primary competitor in this space is ZS Pharma (NASDAQ: ZSPH) whose competing hyperkalemia drug “ZS-9” should be on the market sometime this summer. Relypsa has first mover advantage and its drug is better for patients with high blood pressure which is a significant portion of the hyperkalemia population.

Relypsa was selling north of $40.00 a share earlier in the year before plunging to under $20.00 a share. The shares have been rallying of late and go for approximately $28.00 now. The trigger for the earlier decline was the overreaction to a “black box warning” the FDA gave along with the approval of veltassa. This warning will likely only apply to five to 10% of hyperkalemia population and ZS-9 possibly could get the same warning label when it is approved.

Leave A Comment