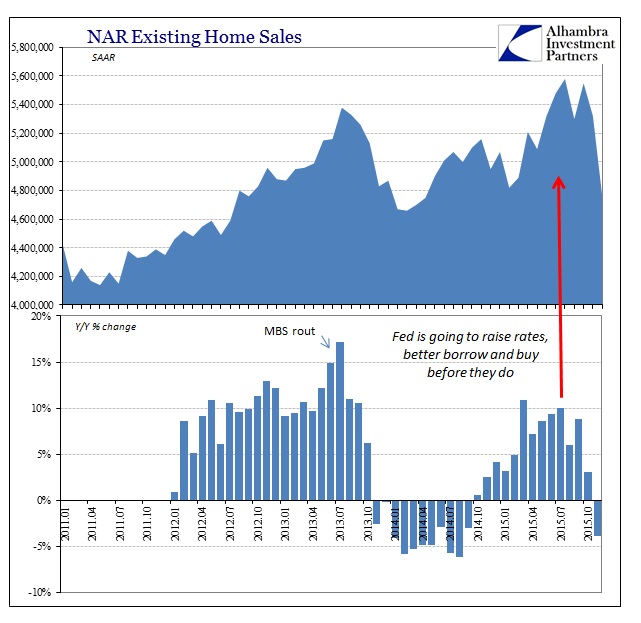

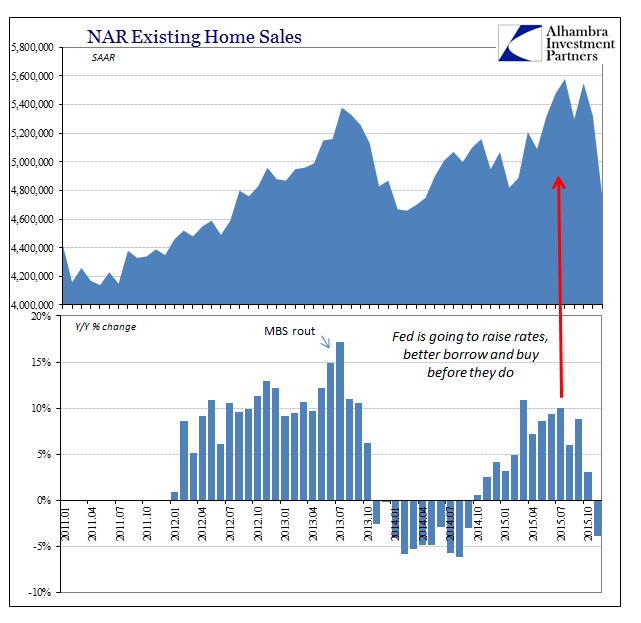

I haven’t reported much on the housing market this year because frankly it has been vastly surpassed by everything taking place (globally) with the “dollar” and the economy that seems stapled to it. However, November’s resale figures from the National Association of Realtors (NAR) have alarmed several lines of commentary normally more assured (friendly to the orthodox recovery). The rate of sales dropped to a 19-month low in November, down 10.5% from October. It’s a large drop but I’m not sure why this wasn’t more widely expected.

U.S. home resales posted their sharpest drop in five years in November, a potential warning sign for the health of the U.S. economy although new regulations on paperwork for home purchases may have driven the decline.

The National Association of Realtors said on Tuesday existing home sales plunged 10.5 percent to an annual rate of 4.76 million units. That was the sharpest decline since July 2010. October’s sales pace was revised slightly lower to 5.32 million units.

Housing has been providing a sizable boost to U.S. economic growth this year as a strengthening labor market and low interest rates have helped young adults to leave their parents’ homes.

Regulatory paperwork is plausible, but that last paragraph is surely overstating housing greatly. If there is a factor that has been driving home sales this year it isn’t jobs and wages, and certainly not college kids leaving their parents’ basement. First-time home buying is still less than 30% even though mortgage rates have been historically low and rather tame. I do think, however, that rates are the reason we have seen this pattern in activity – people have been hearing all year that the Fed was about to raise rates and so they rushed to borrow in order to buy before all that gets undone.

The November decline might signal the end of that push, especially as there was quite a consensus among the general population about a September rate hike (no matter how implausible). I think that point fairly established by housing inventory which is declining rather than rising. You would think if the housing market had attained a durable increase in demand, due to wages and real rather than statistical jobs, rising sales levels and prices would lead to also rising inventory as more sellers become as confident as buyers would appear. These factors tend to correlate.

Leave A Comment