February Bumps

With January now behind us, and as the luster of the election begins to fade, the question becomes what will the month of February bring. While it is impossible to predict outcomes with absolute certainly, we can look at historical precedents to discern the risk that we undertake as investors.

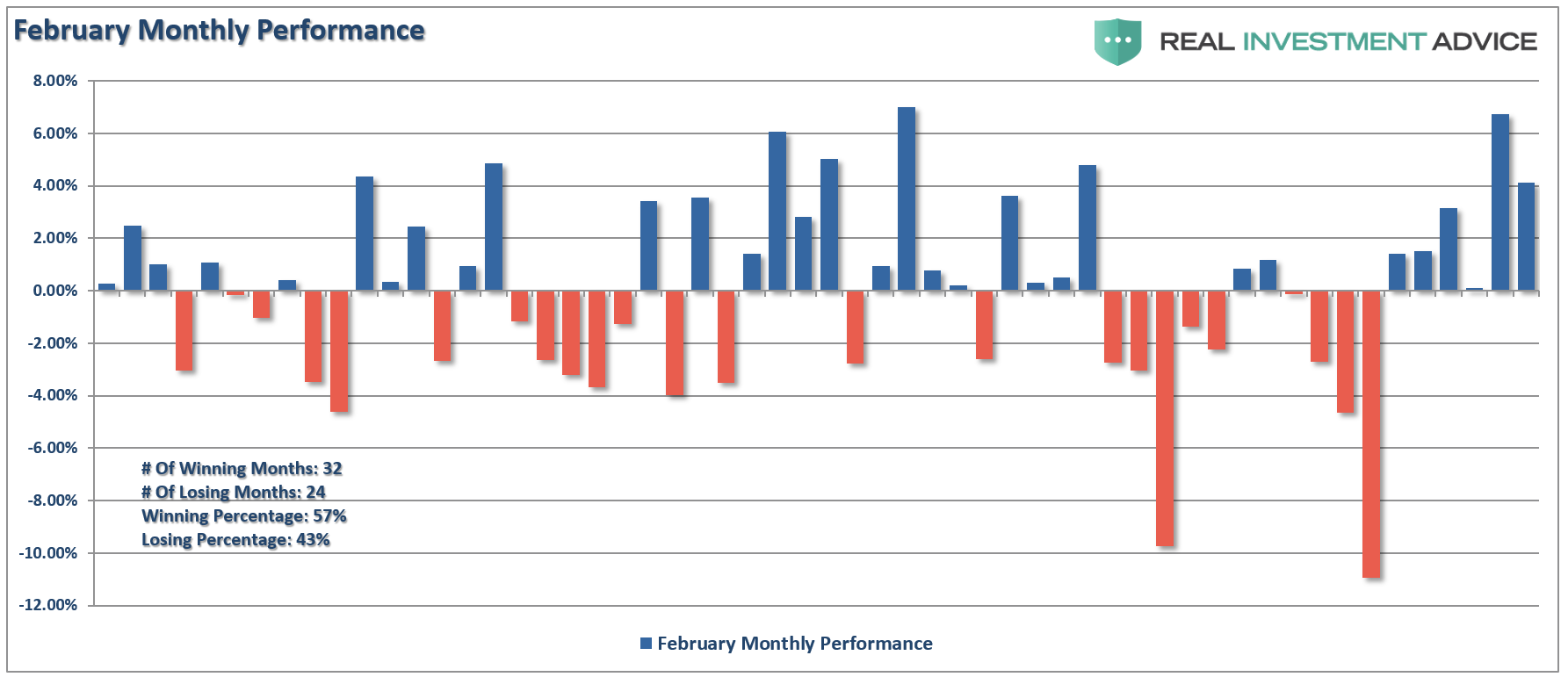

If we look at the month of February going back to 1960 we find that there is a slight bias to February ending positively 57% of the time.

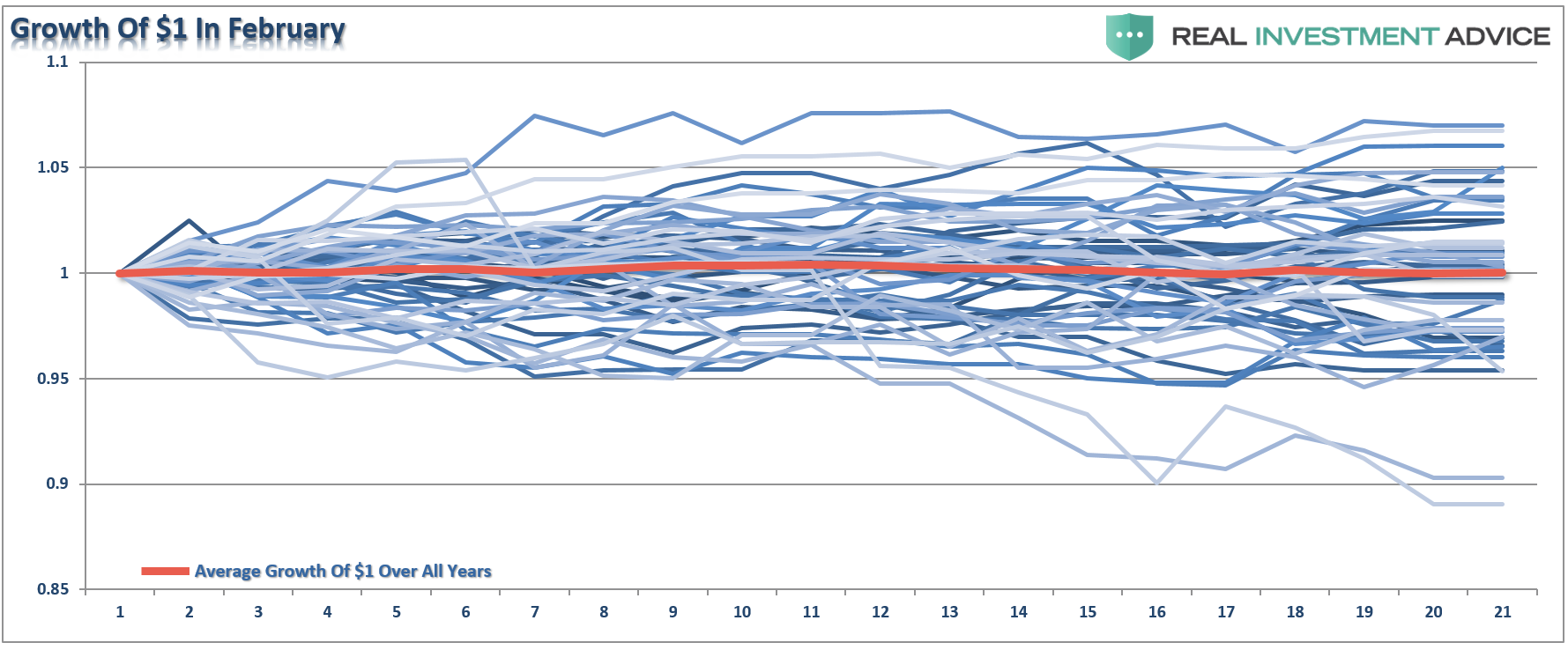

Unfortunately, the declines in losing months have wiped out the gains in the positive months leaving the average return for February almost a draw (+.01%)

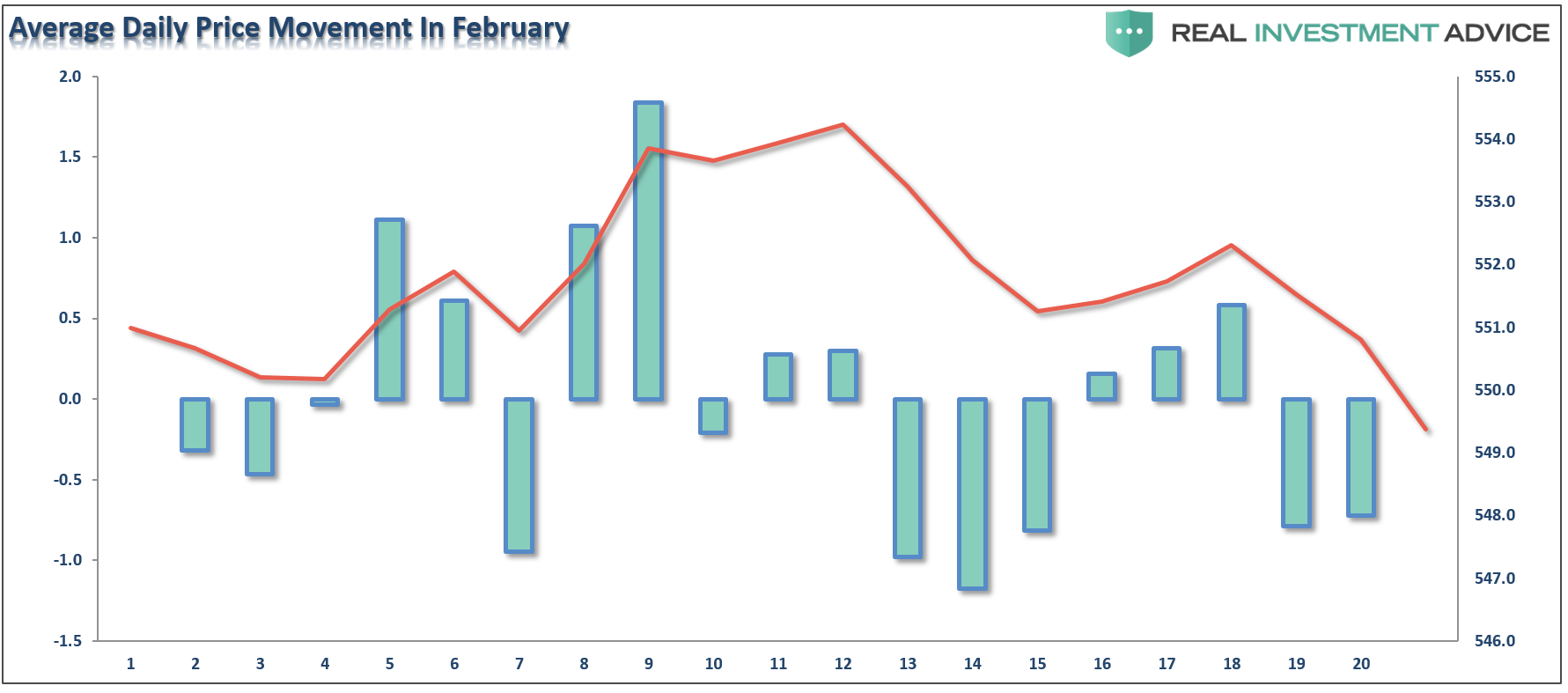

A look at daily price movements during the month, on average, reveal the 4th trading day of February through the 12th day provide the best opportunity to rebalance portfolio allocations and reduce overall portfolio risk.

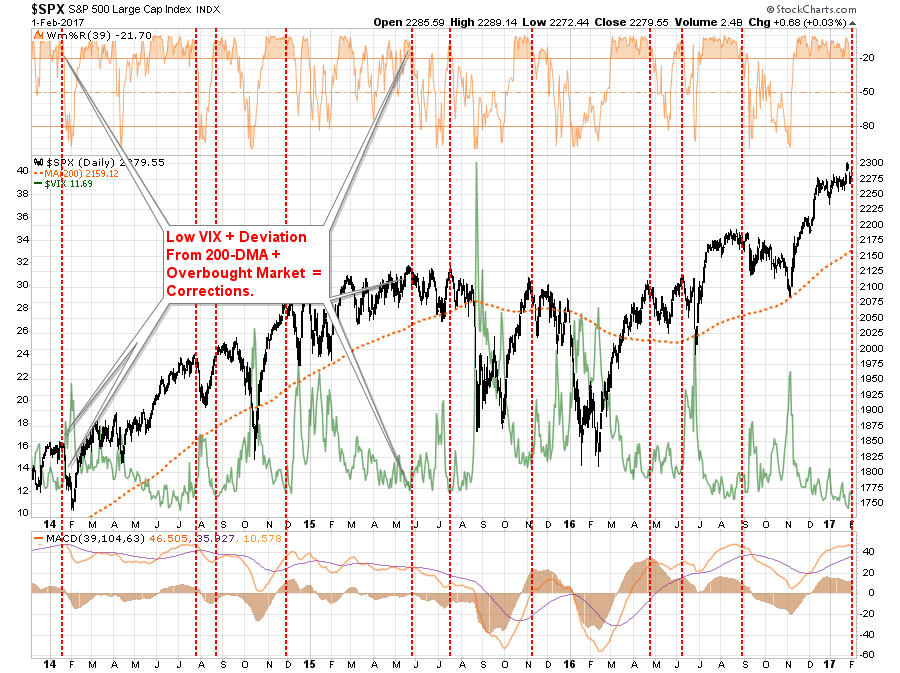

Currently, bullish exuberance is once again pushing extremely high levels. As noted yesterday:

Bulls Jump to 19 Month High of 61.8% in Investors Intelligence Survey pic.twitter.com/pg3KvLVXe4

— Not Jim Cramer (@Not_Jim_Cramer) February 1, 2017

Historically, the combination of excessive exuberance, complacency and extensions have not worked out well for investors in the short-term.

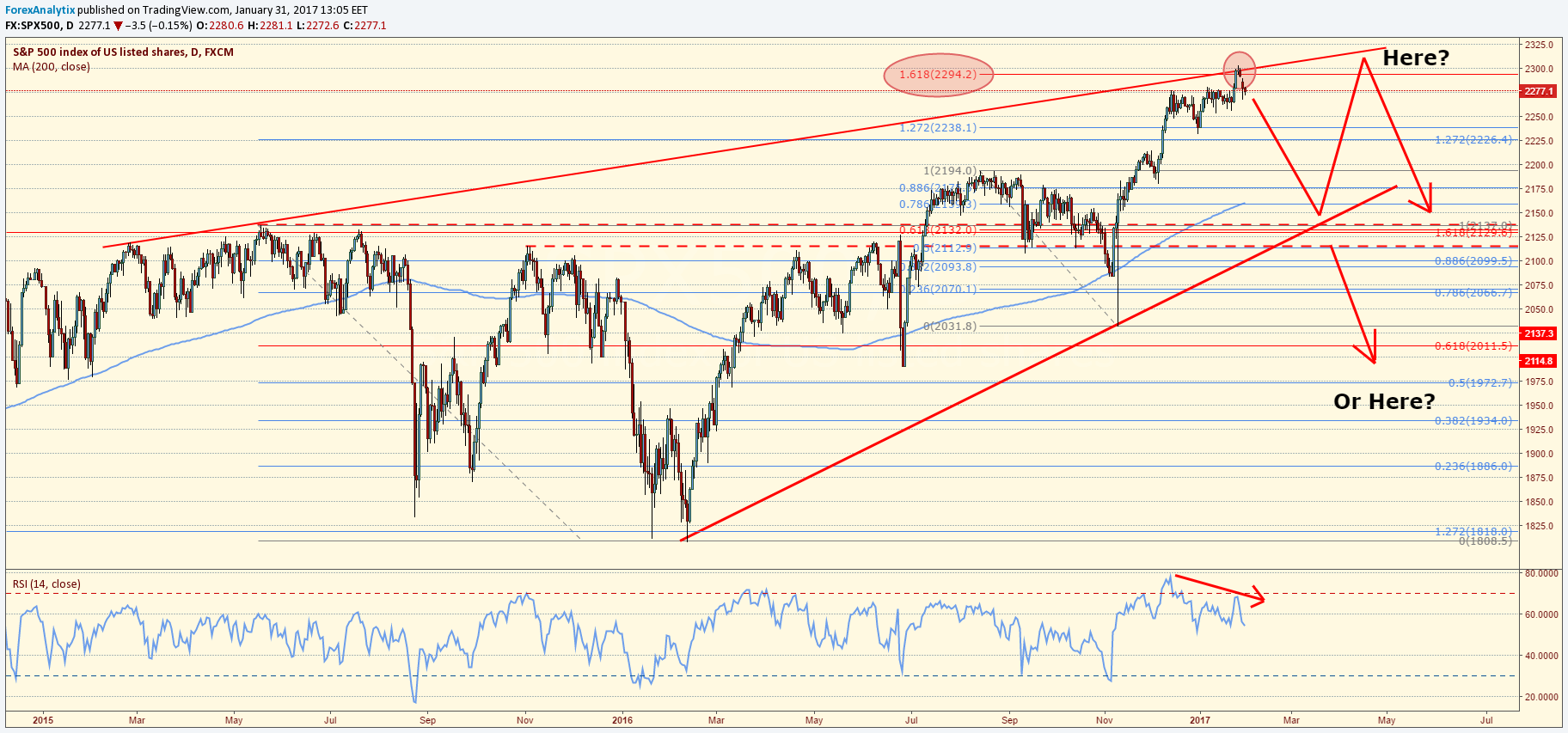

Furthermore, Blake Morrow at Forex Analytix made an interesting point as well:

“We have been making higher highs and higher lows (the definition of an uptrend). However, the rate that the higher highs are happening is lower than that of the higher lows. From this, it follows that we may be developing an ascending wedge. Also, the apex is not as tight in price that I typically like for a reversal pattern.

The animal spirits of the Trump presidency cannot be denied, however, when price exceeds action, or perhaps when it lies way ahead of expectations, the risk for failure in price is quite high. In other words, has price exceeded expectations of the new US administration? Perhaps. Or perhaps the new administration’s risk of not meeting current (high) expectations of the market is also very high, which could allow for a pullback in the broad markets.”

There is sufficient evidence to warrant a continued review of portfolio positioning and reduce risk by:

- Raising cash by reducing overall exposure, or

- Adding positions that will hedge against a market decline, or

- Some of both

Taking some action now will likely pay off in the not too distant future. If I am wrong, then you simply rebalance your portfolio, increase risk and enjoy the ride..

Leave A Comment