The Potential Of A Policy Error Has Risen

Yesterday, the Fed clearly showed they are trapped in their decision to raise rates. Despite an ongoing deterioration in the underlying economic and financial market fabric, Yellen & Co. stayed firm in their commitment to a gradual increase in interest rates.

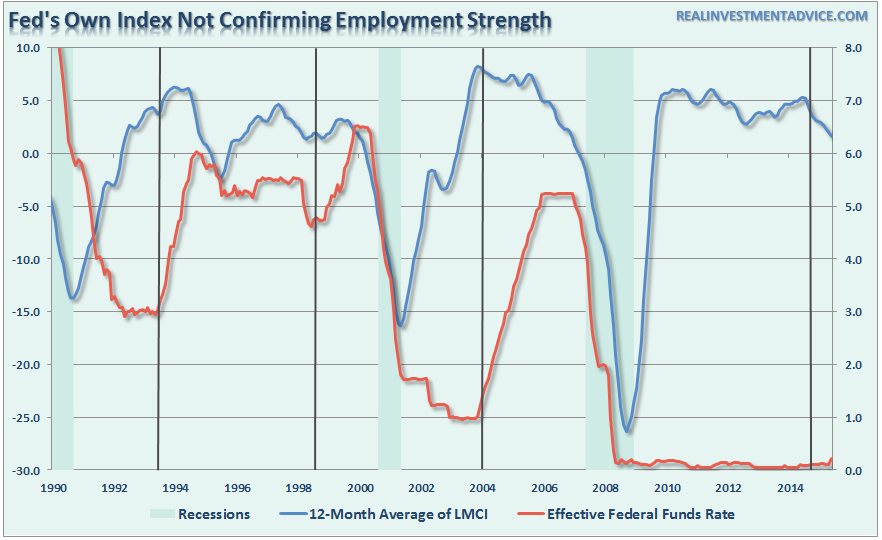

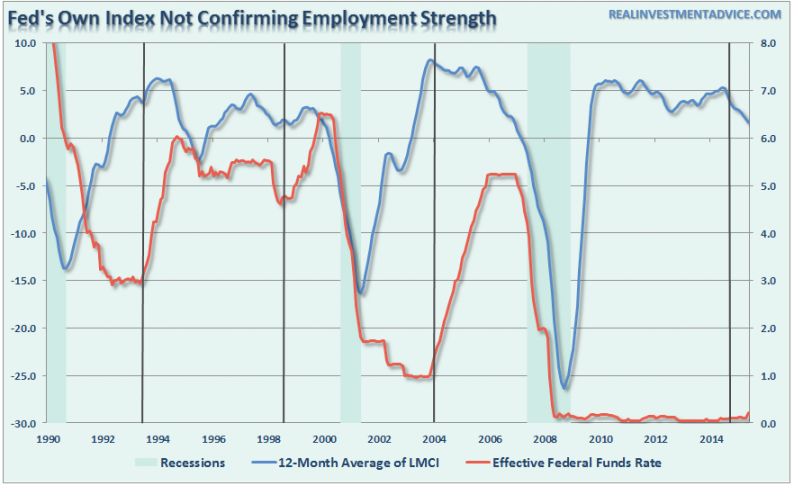

What is most interesting is their focus on headline employment data while ignoring their very own Labor Market Conditions Index (LMCI) which shows a clear deterioration in the employment underpinnings.

But here is the potential problem for the Fed’s dependence on current employment data as justification for tightening monetary policy – it is likely wrong. Economic data is very subject future revisions. While the current employment data has indeed been the strongest since the late 1990’s, there is a probability that the data is currently being overestimated.

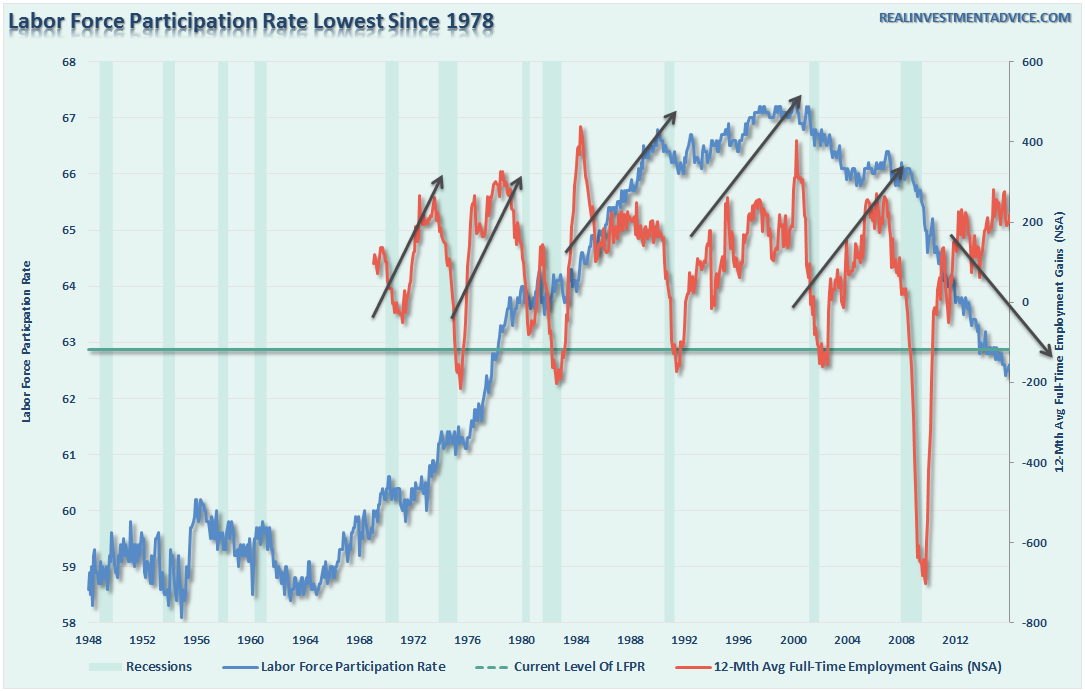

The reason is shown in the chart below.

If the employment gains were indeed as strong as the Fed, and the BLS, currently suggest; the labor force participation rate should be rising. This has been the case during every other period in history where employment growth increased. Since the financial crisis, despite employment gains, the labor force participation rate has continued to fall.

This suggests that at some point in the future, we will likely see negative revisions to the employment data showing weaker growth than currently thought.

The issue for the Fed is by fully committing to hiking interest rates, and promoting the economic recovery meme, changing direction now would lead to a loss of confidence and a more dramatic swoon in the financial markets. Such an event would create the very recession they are trying to avoid.

Inflation expectations are also a problem which compounds the probability of a policy error at this point. As Danielle DiMartino Booth, who left the Fed earlier this year, stated:

“Less anticipated was the adamancy of Committee members that inflation would hit their stated goal of ‘two percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further.’

‘Strengthens further?’ Anyone bother to share the last few weekly jobless claims reports with monetary policymakers?

As for inflation’s prospects, a year and a half into crashing oil prices, the FOMC’s use of the word ‘transitory’ leads one to wonder if they are stuck in some space age time warp. Or maybe they declared it Opposite Day but failed to share that with the rest of us.

While the Fed clearly remains giddily detached from reality, the bond market communicated unequivocally what it thinks about the economy’s prospects: the 10-year Treasury closed below the two percent line in the sand that’s been drawn since the start of the year.“

Leave A Comment